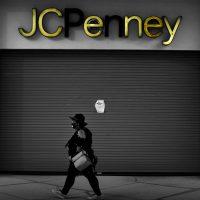

J.C. Penney is saved.

The retailer will be acquired by mall operators Simon Property Group and Brookfield Property Partners, avoiding liquidation.

Simon and Brookfield will pay about $300 million in cash and assume $500 million in debt to buy J.C. Penney, according to the New York Times. Some of the stores and distribution facilities will be divided into two property companies. The deal values the department store chain at $1.75 billion.

“We are in a position to do exactly what we set out to do at the very beginning of these cases and that is to preserve 70,000 jobs, a tenant for landlords, a vendor partner and a company that has been around for more than a century,” Joshua Sussberg, a lawyer at Kirkland & Ellis, which has been representing J.C. Penney, said at a bankruptcy hearing on Wednesday, the New York Times reported.

The move was somewhat expected as the liquidation would have dealt a significant blow to malls.

The retailer is one of the largest stores to file for bankruptcy protection during the pandemic. J.C. Penney entered proceedings with nearly 850 stores and about 85,000 employees.

The company has already closed several stores, resulting in layoffs across New York city and elsewhere.

[NYT] — Sasha Jones

Read more