Trending

EB-5 investor snags Hunters Point resi development: Mid-market sales report

Manhattan whiffs on mid-market i-sales in the week following Labor Day

The Bronx, Brooklyn and Queens dominated the middle of the investment sales market after Labor Day, while Manhattan saw no such deals between $10 million and $30 million in the week ending Sept. 11.

The seven properties trading hands ranged from a defunct bank in Williamsburg to an EB-5 residential project in Hunters Point, a massive self-storage building in Highbridge and a nursing home in the Spuyten Duvil.

1. Saratoga-based Prime Group Holdings purchased a Highbridge self-storage facility at 950 University Avenue for $26 million. It spans 141,170 square feet. The deal included an adjacent parking lot of 10,085 square feet. Tuck-It-Away Self-Storage was the seller, acting through Highbridge Rising LLC. Yehuda Golche and Itan Rahmani of Venture Capital Properties brokered the sale.

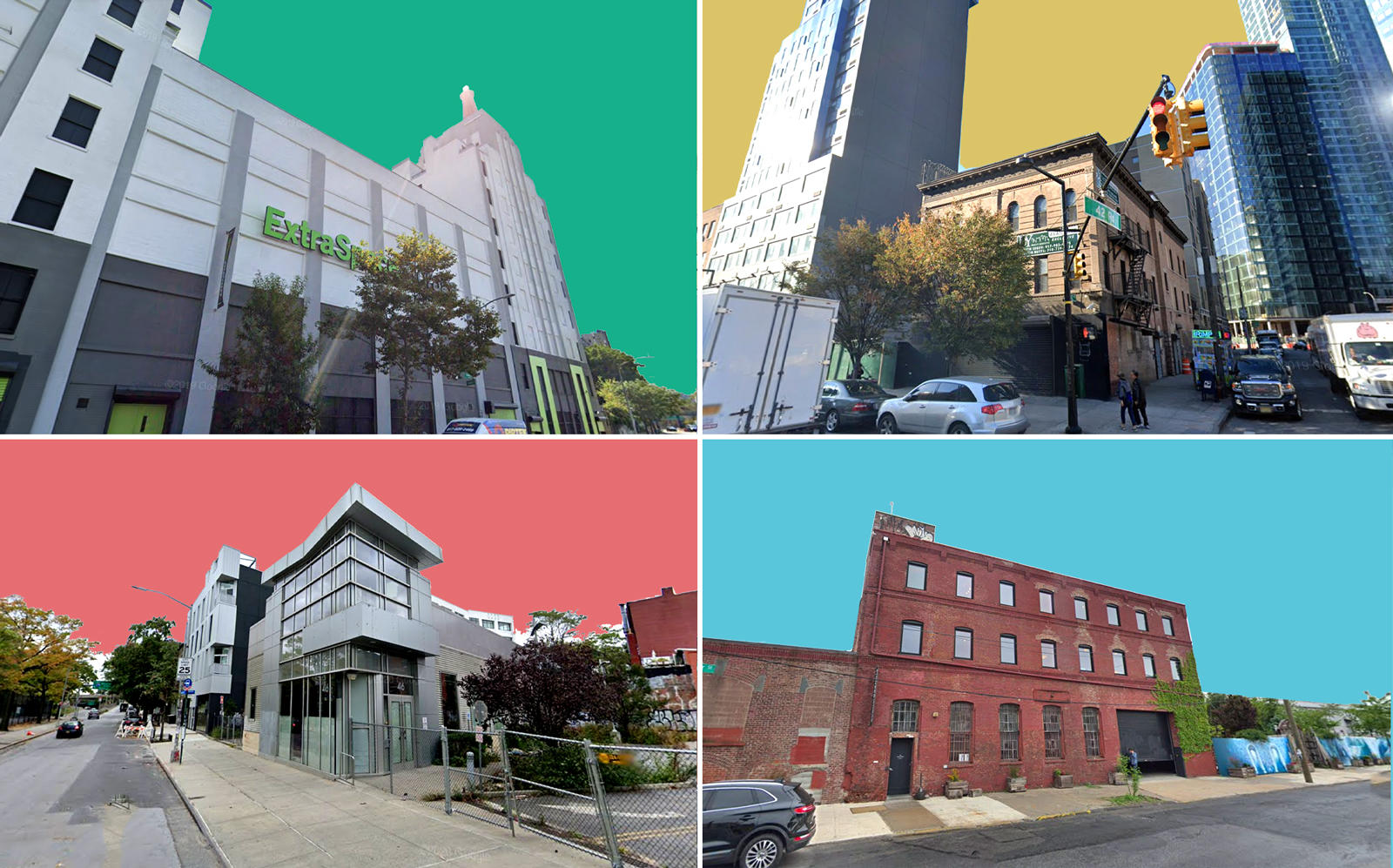

2. Nissim Seliktar sold a vacant lot spanning 4,163 square feet at 27-55 Jackson Avenue in Hunters Point for $12.5 million. In June of last year Seliktar filed plans to develop a 41,409-square-foot residential building at the address. Lily Guo was the buyer, via a limited liability company. The LLC is developing a condo at the neighboring address, 27-51 Jackson Avenue, according to the website of the American Regional Center for Entrepreneurs, which Guo founded. The organization solicits investments in real estate projects through the EB-5 Immigrant Investor Program.

3. Ranco Capital affiliate 420 Metro LLC purchased a 17,586-square-foot lot in Williamsburg for $19 million. The parcel, at 416 Metropolitan Avenue, also known as 2 Marcy Avenue, has a development potential of 52,717 square feet. Formerly the site of a bank, the property was placed into Chapter 11 bankruptcy earlier this year by the sellers — James Mannix, principal of Mannix Properties, via HWM Met/Marcy LLC; and Joseph Mattone via 402 Metropolitan Ave LCC, an affiliate of the Mattone Group.

4. Leopold Friedman, chief executive of Citadel Rehabilitation and Nursing Center at Kingsbridge, bought a 35,462-square-foot nursing home in Spuyten Duvil for $18.4 million at 641 West 230th Street, through the limited liability company Riverdale Real Estate Acquisition. The seller was Eric Paneth, chief executive of Riverdale Nursing Home, acting through 641 West 230th LLC.

5. ZL Capital acquired a Hunters Point industrial building at 27-20 42nd Road for $15.5 million. Taxi-meter manufacturer Pulsar Technology Systems was the seller.

6. Pioneer Works Art Foundation purchased 34,200 square feet across six lots in Red Hook for $10 million. The transaction includes a 14,200-square-foot industrial building at 149 Pioneer Street. The other lots, zoned as parking facilities, include 119, 125, 127 and 133 Conover Street. Pioneer & King LLC was the seller.

7. Goodstein Development sold a 17,175-square-foot retail building in Briarwood at 138-23 Queens Boulevard for $12.95 million, acting through SG Queens LLC, along with co-owner Briar MG LLC. The buyers were listed as limited liability companies RJ Blvd and RJ Blvd II. The building is occupied by a Key Food and Crystal Palace restaurant.

Correction: ZL Capital is a limited liability company registered in New York. Although a majority of its investment comes from China, it is not a Chinese firm.