CMBS delinquencies fell, but hold the applause

CMBS delinquencies fell, but hold the applause

Trending

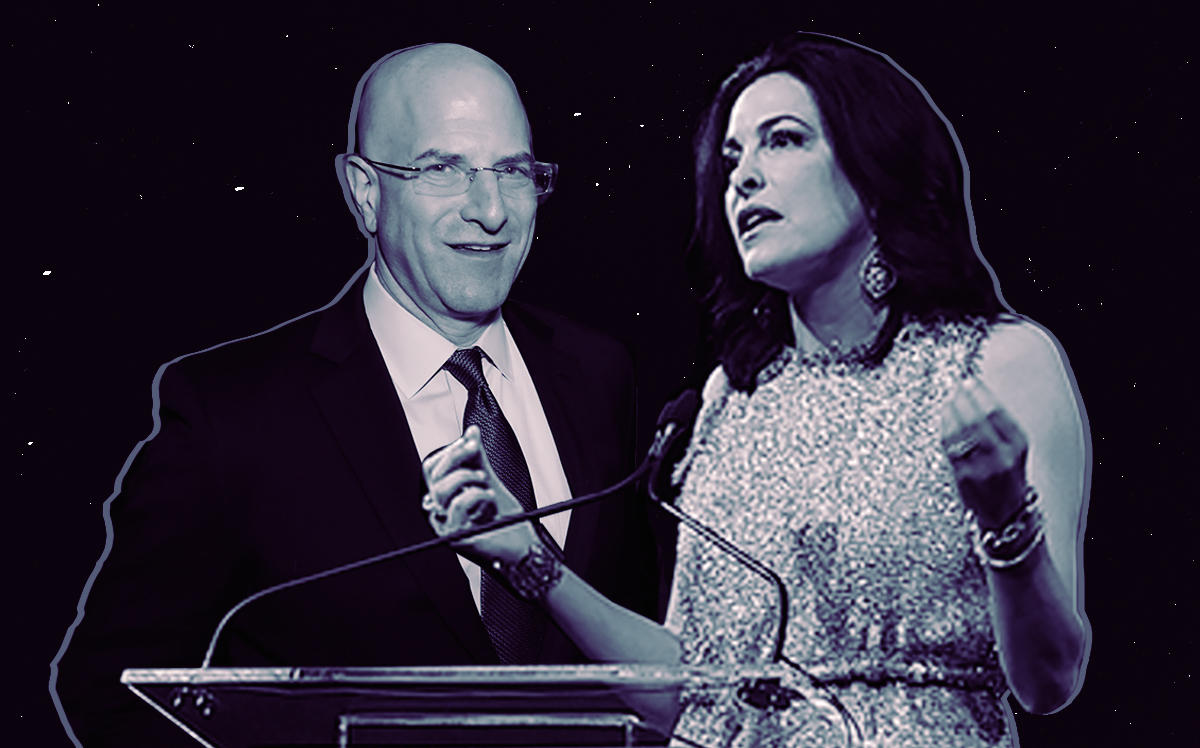

Wendy Silverstein, Ed Adler launch loan restructuring biz

Silver Eagle Advisory Group has a service and fee-sharing deal with Meridian Capital Group

Bombarded by inquiries from clients about mortgage workouts during the pandemic, Meridian Capital Group called Wendy Silverstein. The brokerage wanted the former Vornado Realty Trust executive, who most recently co-headed WeWork’s real estate investment arm, to come on board and put her years of experience in debt restructuring to work.

“I thanked them, but said truthfully I’m done with working for other people,” Silverstein told The Real Deal on Tuesday, recounting the April call. Instead, she pitched forming her own company that could provide such services to Meridian and others.

As a result, Silverstein and Ed Adler, a former colleague and Deutsche Bank executive, launched Silver Eagle Advisory Group. The company has a service and fee-sharing agreement with Meridian, under which the commercial brokerage will work exclusively with Silver Eagle on loan restructurings and workouts. Silver Eagle will accept work from other clients as well.

Read more

CMBS delinquencies fell, but hold the applause

CMBS delinquencies fell, but hold the applause

The company will provide various services nationally, ranging from corporate debt restructuring to single-asset loan workouts for real estate operating companies, owners, borrowers and lenders.

Yoni Goodman, president of Meridian, said the company has seen an uptick in distress across the hospitality, retail and office sectors, along with certain condominium and redevelopment projects. He said that the mortgage brokerage has long considered getting into the workout business.

Adler and Silverstein first met in 1990 at Citibank, on a workout team representing the bank in billions of dollars of corporate debt and asset-level restructurings. Silverstein subsequently spent 17 years at Vornado, where she served as co-head of acquisitions and capital markets. She went on to become CEO of New York REIT, where she was charged with liquidating the company’s 4.4 million-square-foot commercial portfolio in the city. She then served as chief investment officer of WeWork’s real-estate investment fund, departing from the co-working company shortly before it scrapped its plans to go public.

Adler spent more than a decade at Deutsche Bank, where he led the bank’s efforts in re-establishing its commercial lending business in the states. Most recently, he served as head of BentallGreenOak Real Estate’s U.S. credit investment platform.

The new firm is coming online at a tough time for commercial real estate. More than $54.3 billion in U.S. commercial-mortgage backed securities have been transferred to loan workout specialists, largely due to late payments, according to a recent report by Moody’s Investors Services. That, Bloomberg News reported, represented a 320 percent increase since the start of the pandemic.

Adler said the U.S. is in the early stages of a complex downturn, but called the need for “very measured decision making” a constant in all financial crises.

“The banks are not in trouble per se,” Silverstein said of the current crisis. “As a result, banks are going to be playing the game pretty tough.”