Black and Hispanic landlords are struggling to pay their mortgages more than their white counterparts, yet have been offering more rent relief to tenants.

That’s according to a recent survey of 2,225 landlords from the Urban Institute, a Washington-based think tank, and Avail, a rental management platform.

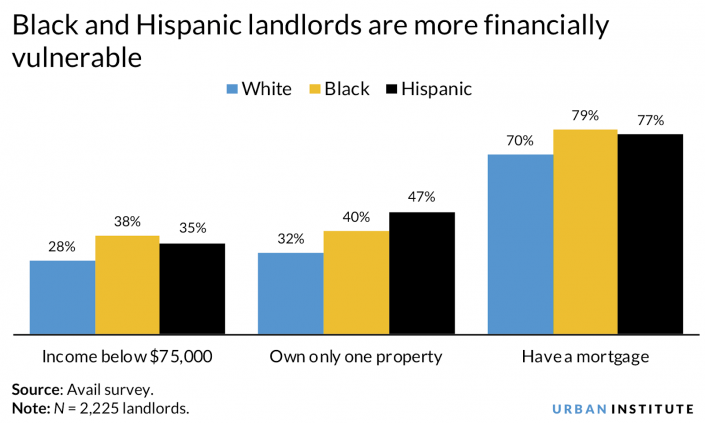

According to the survey, Black and Hispanic landlords typically make less money annually than white landlords, own fewer properties and have mortgage debt at higher rates.

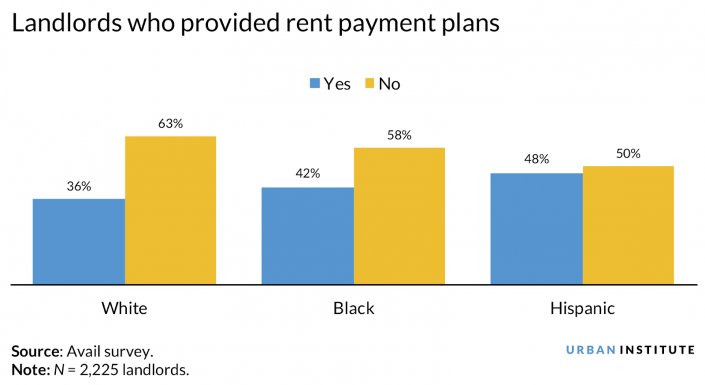

Despite those financial challenges, Black and Hispanic landlords offer rent relief to tenants at higher rates than white landlords, the survey found. Forty-two percent of Black landlords and 48 percent of Hispanic landlords worked with renters on altered payment schedules and deferrals; 36 percent of their white counterparts did the same.

The survey found that Black and Hispanic landlords are more likely to own smaller, two-to-four-unit buildings, where tenants are often less affluent and have jobs at higher risk of layoffs because of the pandemic.

The survey found that 28 percent of white landlords make less than $75,000 annually; for Black and Hispanic landlords, that figure was 38 and 35 percent, respectively.

When it comes to property volume, 32 percent of white landlords own just one property compared to 40 percent of Black landlords and 47 percent of Hispanic landlords.

More white landlords also own their properties free of mortgages. Seventy percent of white landlords have mortgages, while 79 and 77 percent, respectively, of Black and Hispanic landlords have the same.

Black and Hispanic landlords are also more likely to take advantage of mortgage forbearance options than white landlords, according to the survey. About 20 percent of Black landlords and 14 percent of Hispanic landlords have at least one mortgage in forbearance, compared to 9 percent of white landlords. Two-thirds of white landlords opted not to enter into forbearance plans with their special servicers because they could stay current on their payments without forbearance; fewer than half of Black and Hispanic respondents said the same.

The coronavirus pandemic has dealt a massive blow to multifamily landlords and mortgage lenders. Unpaid rent cost landlords about $9.1 billion in revenue in the second quarter, while missed mortgage payments totaled an estimated $16.3 billion, according to a report from the Mortgage Bankers Association.

Even though multifamily rent collections as of Aug. 13 were only down 2 percent annually, some leaders in the multifamily industry have expressed fears that rent collections will decline further as relief through the CARES Act dried up.

The Urban Institute recommended extending an eviction moratorium for tenants, which the federal government extended through the end of the year for those who qualify. It also called on the federal government to provide assistance for struggling landlords, particularly those who owns fewer than 10 rental units, who “may not be able to continue making their mortgage payments and keep their tenants housed.”