Lisa Davidson vividly remembers the freezing temperature that numbed her toes one winter day several years ago as she toured prospective buyers through downtown Chicago’s dilapidated but cavernous Old Post Office and its leaky roof.

“It was hard to even walk through the building because it was in such poor condition from being vacant over the years,” said Davidson, a Savills broker who was part of the team representing the seller in England.

New York-based 601W Companies ultimately bought the property for $130 million in 2016 and completed an $850 million redevelopment, transforming the 2.8-million-square-foot complex on West Van Buren Street into a modern office building, while restoring its Art Deco features.

Lisa-Davidson, Savills

The massive space attracted big tenants like Uber, Walgreens and Ferrara Candy, as Chicago’s booming office market began luring young professionals along with the companies that had been operating from suburban campuses. McDonald’s also moved its headquarters to red-hot Fulton Market, where it signed a long-term lease for nearly 500,000 square feet in a new building from developer Sterling Bay.

But now seven months into the pandemic, firms have been fleeing the city.

The work from home revolution has led companies to scale back on existing office space or exit leases entirely. Some businesses, like freight tech firm Flexport, have decided to sublease office locations they had just inked a deal to occupy, before even moving in.

The shift has exposed weaknesses in the market that may have been hiding in plain sight. Those include the fact that demand was relegated mainly to Fulton Market and the West Loop, brokers and developers said. Now, industry players must chart a new course back, but the rapid retreat has left some to wonder whether the soaring success can be recreated anytime soon.

Sublease tsunami

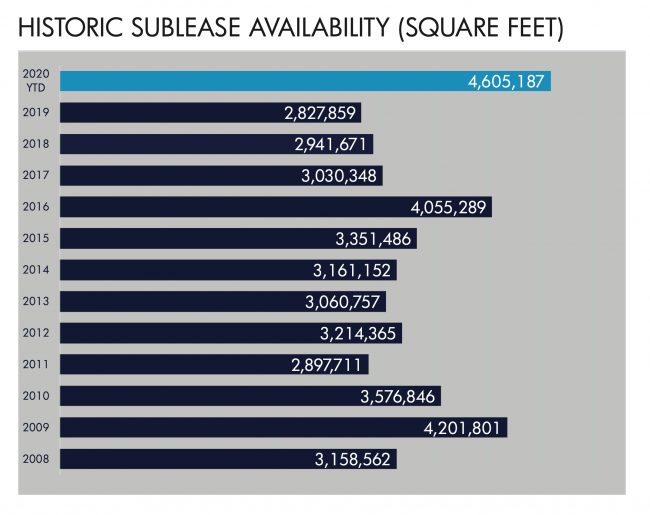

Available office sublease space in the city reached a record 4.6 million square feet in the third quarter, according to MB Real Estate. The total office vacancy rate climbed to just under 16.6 percent, the highest it’s been in a decade.

Bradley Serot, CBRE

Tech firms have pulled back, not long after taking large spaces in anticipation of growth, said CBRE’s Bradley Serot, who leads its tech group.

“They’re downsizing or rightsizing,” Serot said. “They don’t need the space as robust and large because they’re not going to recruit as much as what they were planning.”

Groupon, the Chicago-born online coupons and deals giant, led the early wave of companies scaling back. In late April, it listed for sublease 150,000 square feet — about half its headquarters — at 600 West Chicago Avenue. Toast, a cloud-based restaurant software provider, followed suit by trying to unload half of its 50,000-square-foot office at 515 North State Street. Last month, automotive classified website Cars.com listed about 50,000 square feet, a third of its West Loop tower headquarters.

Folks are interested in a less dense working environment where you are not sharing an elevator,

And while 601W Companies recently opened its renovated 3.5-acre rooftop at the Old Post Office, the $19 million Meadows will likely not be seeing too many workers anytime soon. Uber, the largest tenant, announced back in April it would pause construction on its 463,000-square-foot space set for Uber Freight. The company plans to resume work in January, aiming for a 2021 move in.

Trendy Fulton Market has also seen a tenant retreat. Chief among them is WeWork, which abandoned plans to open two locations totaling 110,000 square feet, at 1155 and 1114 West Fulton streets. CCC Information Services, an auto insurance software company, also scaled back its space at 167 North Green Street.

Scott Modelski, Black Bear Capital Partners

The rise of subleasing could have long-term effects on property valuations when those buildings hit the market, or when owners seek refinancing, said Scott Modelski with Black Bear Capital Partners.

“If you have a tenant roster where you have the tenants who are paying but not occupying, and they’re looking to sublease, that’s going to be something that raises some eyebrows,” he said. “Because I think there’s a concern about how long they’re willing to keep feeding their lease without actually taking occupancy.”

The falling Chicago office market has benefited owners of suburban office parks, which have seen a rise in demand among investors and tenants, Modelski added.

“Folks are interested in a less dense working environment where you are not sharing an elevator,” he said.

That has meant bad news for fledgling developers like Parkside Realty. Founded last year by veteran brokers Bob Wislow and Camille Julmy, the firm’s newly constructed 12-story boutique office building at 215 North Peoria Street received a certificate of occupancy in early October.

“We couldn’t show our space right when we were ready to show it,” said Wislow, who is still searching for tenants. Still, he is hopeful, noting that the building’s smaller floorplates, ample windows and touchless elevators and restrooms have started to attract interest from companies looking to operate safely in the Covid era.

Winners and losers

A down market always brings out the opportunistic investors, said Laura Dietzel, real estate senior analyst with RSM, an auditing and consulting firm. She expects an uptick in distressed properties offered at reduced prices, though that hasn’t happened yet.

“If there is softness in the market, and an opportunity to purchase assets at a discount, there’s a lot of dry powder waiting on the sidelines to take advantage of that,” she said.

Modelski agreed, saying, “We’re all waiting for the distress to come across the market in a lot of asset classes. You’ll see it in office. It just hasn’t materialized as of yet.”

One property that went into special servicing in June was Rampante Realty’s 487,000-square-foot Loop office building. Rampante failed its April and May debt service on a $48 million loan, after Robert Morris University vacated its 355,000-square-foot space at the landmark property.

A possible silver lining for office tenants will be a willingness among some landlords to lower rent, which had spiked in recent years, said Savills’ Davidson.

“With the pandemic and a new approach to workplace, and thinking about working from home and maybe some companies needing less space, that’s going to have a real impact on the office market,” she said. “The good part of that is that tenants will be able to get very attractive rental rates.”

Click to enlarge (Source: MBRE)

Despite the bleak market, new development projects across the city remain on track. And in October, Flex-office provider Industrious even signed a 52,000-square-foot lease at Blackstone Group’s Willis Tower. In perhaps a sign of the times, the two companies are sharing the proceeds from the new space.

Developer Fulton Street Companies, which focuses on Fulton Market, is breaking ground in October on its 150,000-square-foot spec office building at 1043 West Fulton Street, said co-founder Alex Najem. The project was initially planned as a hotel but pivoted to office.

“By the time we deliver the product, there’ll be a lot more tenants in the market,” he said, sounding a note of optimism. Najem said he aims to attract showroom tenants like Herman Miller, which last year agreed to lease Fulton Street Companies’ 45,000-square-foot space at 1100 West Fulton Street.

Sterling Bay’s Lincoln Yards megaproject on the North Side is also on track.

“They are moving ahead despite Covid,” said Joseph Schwieterman, a DePaul University professor who focuses on urban planning and directs the Chaddick Institute for Metropolitan Development. “That’s been very encouraging.”