Few issues in California this year have generated as much debate as Proposition 15, the “split-roll” ballot measure that could raise property taxes on commercial and industrial properties for the first time in decades.

Groups representing California landlords and developers have spent $20 million this year opposing Prop 15. Supporters of the bill raised about $30 million during the same period of time.

Prop 15 would update Prop 13, a ballot measure passed in 1978 that restricts municipalities from reassessing property values unless their ownership changes. Prop 15 would alter the assessment schedule for commercial and industrial properties, mandating that they be reassessed each year to reflect their market value.

But residential properties would still be reassessed only when they come under new ownership.

The measure would generate up to $12.5 billion a year in new tax revenue, according to one nonpartisan analysis.

Some opponents claim Prop 15 will worsen the massive housing shortage in California by incentivizing municipalities to rezone residential districts to industrial to increase tax revenue. However, according to a recent analysis published by the nonpartisan Washington-based Urban Institute, that scenario isn’t very likely.

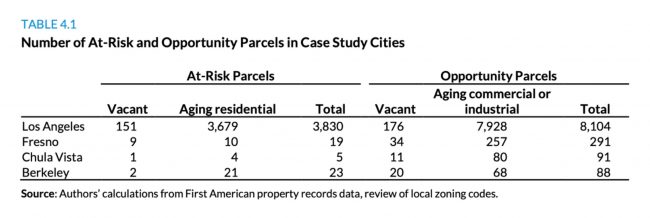

That’s because the number of parcels that could plausibly be rezoned to increase tax revenue is relatively low, according to the report. Parcels at risk of being rezoned to commercial and industrial include vacant lots and parcels with older housing that are near industrial or commercial areas. In Los Angeles, there are only 3,679 such parcels, according to the report.

Proposition 15 could actually lead to more housing, the analysis argued.

The measure will encourage some owners of decrepit commercial or industrial properties to seek to rezone them to residential to avoid the greater tax liability, according to the report. The Urban Institute researchers identified more than 8,000 so-called “opportunity parcels” in Los Angeles where commercial or industrial parcel owners could save on taxes by rezoning to residential.

But even though Prop 15 might stimulate some growth in the housing supply, the Urban Institute researchers note that “far more dramatic actions” are needed to address California’s housing shortage.