From the trajectory of the economic recovery to the finer points of local tax laws, the outcome of the 2020 election is expected to have a major impact on the real estate industry, including publicly traded real estate investment trusts.

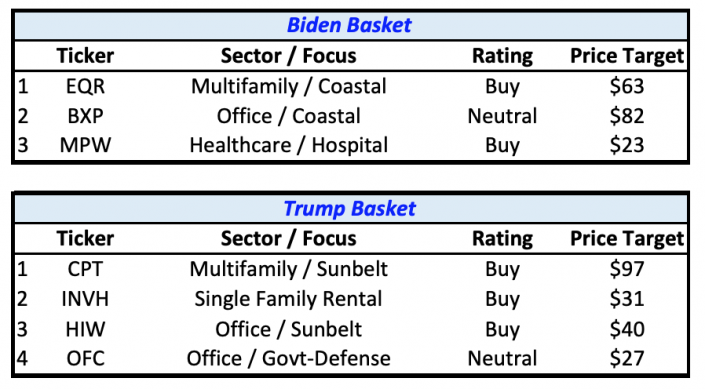

With third-quarter earnings reports just around the corner, REIT analysts with Mizuho Securities USA looked at the sectors of the industry most likely to benefit from a Biden victory or a Trump re-election and selected a handful of representative companies for each scenario.

(Source: Mizuho Securities USA 3Q20 Earnings Preview, page 6)

“We would view a Trump win as a net benefit for non-gateway markets, especially in the Sun Belt (red states), given Trump’s reluctance to provide federal funding to coastal, gateway ‘anarchist’ markets,” the analysts said in their third quarter earnings preview. (“Gateway” markets are loosely defined as “blue states” like New York and California.)

“The focus on domestic trade by the Trump administration also bodes well for the Sun Belt region given the heavier focus on manufacturing versus the coastal markets,” according to the report.

As such, Mizuho’s “Trump Basket” includes companies concentrated in non-gateway, Sun Belt markets like Houston multifamily REIT Camden Property Trust, Dallas single-family rental giant Invitation Homes and office REIT Highwoods Properties, based in Raleigh, North Carolina.

Another type of REIT that stands to gain from a Trump win is office landlords with government and defense tenants like Maryland’s Corporate Office Properties Trust, which mainly owns office buildings in Washington, D.C.

“Given the massive fiscal spending to combat the impact of the Covid-19 pandemic, the concern is that Biden would need to reduce the deficit and balance the budget, even though he is generally supportive of defense spending,” according to Mizuho’s analysts.

(While Biden has put forward a plan to raise taxes on households earning more than $400,000 and corporations, he is not expected to balance the federal budget, which was running an annual deficit of more than $1 trillion even before the pandemic and has not been balanced since the Clinton administration.)

On the flip side, the “Biden Basket” includes companies with more gateway-city exposure like Sam Zell’s Equity Residential and office landlord Boston Properties. (By the same reasoning, landlords like SL Green, Vornado Realty Trust, Paramount Group, and Columbia Property Trust would also fall in this basket, although they are not named in the report.)

Also at stake in the election is the fate of the Affordable Care Act, which could have an impact on health care REITs such as Birmingham, Alabama-based Medical Properties Trust, which owns hospitals in 34 U.S. states as well as six European countries and Australia.

Read more

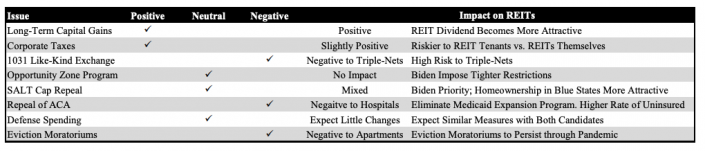

(Source: Mizuho Securities USA 3Q20 Earnings Preview, page 4)

A number of policies backed by the Biden campaign could have major impacts on the real estate world if enacted.

The proposed elimination of 1031 “like-kind” exchanges would be negative for REITs overall, reducing transaction volume and liquidity while increasing the gap between bids and asking prices, Mizuho analysts say. Triple-net lease REITs could take a major hit, given their appetite for acquisitions.

Meanwhile, the repeal of caps on deductions for state and local taxes, which is also a Democratic priority, would likely boost the residential real estate market in blue states with high taxes, notably New York, New Jersey and California.

The report also takes a close look at several ballot measures in California that are set to shake up the local real estate industry. Proposition 15, which would reassess the tax bills for commercial properties worth $3 million based on fair market value, has a lead in the polls and has received support from Biden.

Meanwhile, polling on Proposition 21, which would let counties and cities impose rent control on residential properties not built within the past 15 years, is more evenly split between supporters and detractors, with a large portion of voters still undecided.

Somewhat counterintuitively, Mizuho analysts note that tax policies supported by the Biden campaign could prove beneficial for REITs in particular, if not real estate in general, thanks to the tax advantages associated with them.

“An increase in corporate taxes and capital gains tax rate makes REITs relatively more attractive than other asset classes,” the report states. “A change in tax law, however, requires congressional action, suggesting that a ‘blue wave’ is further needed for REIT stocks to see any post-election momentum.”

Democrats need to flip four Senate seats to capture a majority of that chamber, but could also control it by flipping three and winning the White House.