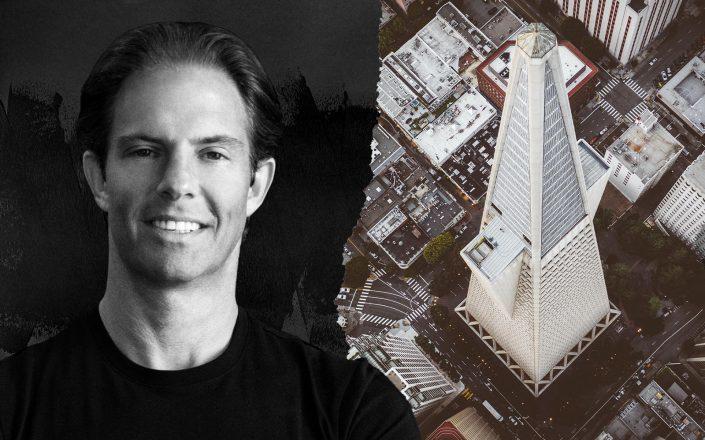

Michael Shvo and the Transamerica Building in San Francisco and (Unsplash)

A group led by Michael Shvo’s eponymous firm and Deutsche Finance America has closed on the purchase of the Transamerica Pyramid, located in San Francisco’s Financial District, for $650 million, Bloomberg reported.

In a joint statement Wednesday, the group described the 48-story skyscraper as “San Francisco’s most recognizable office tower and a fixture in the waterfront skyline for nearly 50 years.”

Opened in 1972, the tower at 600 Montgomery Street has never been sold before. The sellers, Dutch insurance company Aegon NV, took over the site in 1999 when the company purchased original owner Transamerica Corporation.

Read more

The deal includes three buildings collectively spanning 750,000 square feet, including an office building at 505 Sansome Street, a redevelopment site and the pyramid-shaped tower. Shvo and Deutsche Finance had originally negotiated a purchase price of around $700 million for the complex, but received a discount due to the pandemic.

“This iconic tower is an important addition to our portfolio,” Shvo said in a statement. “We’re thrilled to bring this property into its next renaissance.”

But the backdrop of that renaissance is an increasingly fragile real estate market in San Francisco, where vacant office space has doubled in recent months, according to Bloomberg. Rents for Class A offices have also dropped.

Shvo and his partners have closed on a string of major deals in recent years, including the “Big Red” office tower in Chicago; at $376 million, it was the biggest real estate deal in Illinois since the pandemic hit.

[Bloomberg] — Sylvia Varnham O’Regan