Like many around the world, WeWork is looking to forget this year and pick up where it left off in 2019.

The office-space company is going to revisit plans for an initial public offering in 2021, when it expects to turn a profit, Bloomberg News reported.

“I’m a big believer in one step at a time so let’s hit profitable growth first, and we’ll then revisit the IPO plan,” company CEO Sandeep Mathrani told a group of reporters in India Wednesday during a Zoom conference call from New York.

Read more

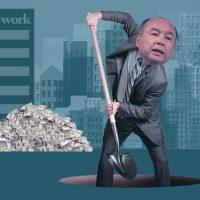

Mathrani joined WeWork in February after the company abandoned plans for an IPO late last year. The former GGP executive oversaw an effort to turn around the company by cutting costs. WeWork let go about a third of its workforce, or more than 8,000 employees, which led to about $1 billion in annual savings.

Mathrani said the company is “100 percent done with rightsizing.”

The company is also about 75 percent complete with a review of its global portfolio.

“In Q1, we were at 66 percent occupancy; with the cost cuts that would be where we see cash coming in,” the CEO said. “We will get to that level by next year.”

The SoftBank-backed company still faces some significant challenges, though. There are big questions surrounding how the global pandemic will impact demand for WeWork’s space. Ratings agency Fitch recently downgraded WeWork’s credit rating. [Bloomberg] – Rich Bockmann