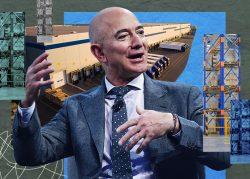

Amazon is continuing its expansion spree in the five boroughs with a major warehouse deal in Brooklyn.

The e-commerce giant signed a 20-year, 311,796-square-foot deal at 280 Richards Street in Red Hook, an industrial property owned by Joe Sitt’s Thor Equities, Commercial Observer reported.

Thor originally planned to develop the 7.7-acre complex into an 800,000-square-foot office development, dubbed “Red Hoek Point,” that would have included retail and a waterfront esplanade. But in 2019, the developer dropped that plan in favor of turning the property into last-mile warehouse.

Read more

Industrial leasing, particularly for e-commerce companies, is one sector of real estate that hasn’t been as badly affected by the pandemic. Activity in the sector was up 70 percent in the third quarter of 2020, according to a recent CBRE report, with the Amazon deal one of the biggest inked.

Thor was in the process of shifting its core business from retail, which has struggled, to industrial before the pandemic hit. Last year, Sitt’s firm started a new business, ThorLogis, that’s dedicated to purchasing and developing logistics properties.

Thor has also offloaded some of its Manhattan retail properties in recent years, including a commercial condo at 51 Greene Street and three retail condos at 212 Fifth Avenue.

Amazon has inked more than one million square feet of warehouse space this year, including a 975,000-square-foot warehouse at the Matrix Global Logistics Park in Staten Island.

[CO] — Akiko Matsuda