As the pandemic continues to squeeze Manhattan’s market-rate rental towers, the island’s affordable apartment buildings are seeing a surge of interest from buyers seeking their stable rent payments.

In what is set to be the biggest multifamily trade in Manhattan since the start of the coronavirus, the Related Companies has inked a deal to buy a pair of Section 8 buildings on the Lower East Side for more than $400 million, sources familiar with the negotiations told The Real Deal.

The luxury real estate investment firm, which got its start in the 1970s buying and rehabilitating affordable housing, is purchasing the properties in the Two Bridges section of Manhattan from a partnership of CIM Group and L+M Development Partners.

Read more

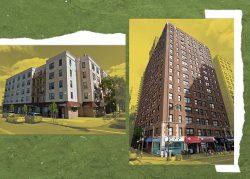

The buildings at 265-275 Cherry Street, known as Lands End II, hold roughly 500 units combined and have their rents backstopped by the reliable federal Section 8 project-based voucher program. Related is buying them for $435 million, or about $870,000 per apartment.

Representatives from Related did not immediately respond to a request for comment, and a spokesperson for L+M and CIM declined to comment. A Cushman & Wakefield team of Adam Spies, Doug Harmon, Josh King, Adam Doneger, Marcella Fasulo and Kevin Donner negotiated the sale. The brokers did not immediately respond to a request for comment.

The deal is the latest in a string of big-ticket transactions pulling what is traditionally the lifeblood of the Big Apple’s investment sales market out of the grave.

MKF Realty recently lined up financing for its purchase of the mixed-income One Union Square South apartment and retail building for about $200 million, a deal set to close later this week. Related is the seller in the deal.

And earlier this month, multifamily investment firm Black Spruce Management bought a portfolio of apartment buildings near the northern end of Central Park for about $200 million.

A common thread among the properties is an affordable-housing component. Experts said those buildings are attractive to investors now because rents are more reliable than those in market-rate buildings, which have seen some white-collar tenants move to outer boroughs or flee the city.

The Section 8 contract covering 265-275 Cherry Street is a long-term agreement wherein the federal government provides a subsidy for tenants to cover their rent.

Ron Moelis’ L+M teamed up with the Los Angeles-based private equity firm CIM to buy the properties in 2013 for about $280 million.

The developers plan to build a pair of 700-foot mixed-income apartment towers on a parking lot adjacent to the buildings, part of a controversial proposal for four skyscrapers in the neighborhood.

After much back-and-forth in the courts over whether the proposed developments require new zoning, a Manhattan judge in August green-lighted the projects. L+M and CIM’s development site is not part of the sale.

Related, meanwhile, has its hands full with major luxury investments including Hudson Yards, where Neiman Marcus, the initial anchor tenant at its ambitious shopping mall, terminated its lease over the summer after filing for bankruptcy.