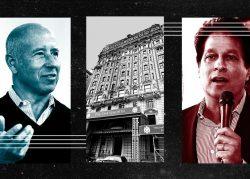

Ziel Feldman has listed his Upper East Side penthouse for $39 million, as the embattled developer faces pressure from lenders seeking to recoup hundreds of millions of dollars.

The 6,200-square-foot triplex spans the top floors of the Marquand, a Beaux Arts mansion that Feldman’s HFZ Capital converted into 40 condominiums in 2013. A corporate entity tied to Feldman took ownership of the penthouse in 2018, according to property records, and obtained a $19.8 million mortgage from Bank of America last year.

11 East 68th Street PH W (Courtesy of StreetEasy)

The five-bedroom unit was designed for entertaining with expansive common areas, exotic finishes and 2,600 square feet of outdoor space, according to the listing. The second floor features two home offices, one with built-in bookshelves. A 700-square-foot terrace on the second floor has an indoor-outdoor fireplace, summer kitchen, dining area and fire pit. A sunroom and 256-square-foot terrace top the third floor.

When the Marquand debuted in 2013, the penthouse was listed for $46 million. The current asking price works out to just over $6,300 per square foot. Douglas Elliman’s Madeline Hult Elghanayan and Sabrina Saltiel have the listing. They could not be reached for comment.

Asked to comment on the listing, a spokesman for Feldman said, “This unit was renovated personally by principals of the sponsor and is the last unit remaining from the original sponsor units.” But in 2013, Feldman said he and his wife, Helene, had moved to the Marquand and planned to sell a lavish home in New Jersey where they raised their children.

The listing comes as the developer contends with several lawsuits over delinquent loan payments tied to several of his firm’s condo projects.

Read more

Earlier this month, the lender on HFZ’s planned condo project at 1135 Lexington Avenue sued the firm over an alleged $18 million in defaulted debt, which Feldman and Nir Meir, an HFZ principal, personally guaranteed. Starwood has also sued HFZ for $157 million after the developer allegedly defaulted on loan payments for a co-op conversion at the Chatsworth at 244 West 72nd Street. Four of HFZ’s condo loans are being marketed through a foreclosure sale, The Real Deal reported in September. And over the summer, HFZ was sued for not vacating the sales gallery for the XI condominium in the Meatpacking District when the lease expired in June.

Sales have been slow at the XI, a 236-unit condo project that sits along the High Line. In 2015, the developer paid an eye-popping $870 million for the site, and later secured a $1.25 billion loan to construct two luxury towers designed by Bjarke Ingels. This spring, HFZ discussed selling a chunk of discounts units at the project. As of September, 38 units were in contract to be sold, according to an amendment to the condo offering plan.

Last month, Feldman sold his massive home in Englewood, New Jersey, after nearly nine years on the market. The sale price was $6.995 million, according to Redfin. The 18,500-square-foot house, which Feldman and his wife built in the late 1990s, had been on and off the market over the years, at one point asking as much $19.5 million. The Feldmans put $13 million worth of work into the French-style chateau, the Wall Street Journal reported in 2011.

In addition to the penthouse at the Marquand, Feldman owns an estate on Dune Road in Bridgehampton, which two sources said has been quietly shopped. Feldman’s representative denied the property was for sale.

Additional reporting by Keith Larsen and Rich Bockmann.