Trending

The rise of soundstage real estate, by the numbers

Investment giants have been gobbling up film and TV studio space

Private equity giant Blackstone announced in June that it would acquire a 49 percent stake in a portfolio of television and film production spaces in Los Angeles County.

Blackstone’s bet on Hudson Pacific Properties’ $1.65 billion portfolio signaled that soundstage space, as the industry calls it, had entered the big leagues. During HPP’s last quarterly earnings call, CEO Victor Coleman said Blackstone’s acquisition “provides validation to the stock market” for his firm’s decision to “assemble the largest collection of independent soundstages in the United States.”

It’s not just Blackstone. Institutional investors are increasingly entering the soundstage market, encouraged by healthy demand for production space from such investment-grade streaming companies as Hulu and Netflix as well as from lumbering entertainment behemoths such as Disney.

Hackman Capital and Square Mile Capital, for example, also made a recent soundstage play with a $500 million acquisition of Silvercup Studios in New York.

The pandemic has only driven up demand for soundstage space, in part because streaming services need to keep up with pandemic-induced appetites for content, according to a recent CBRE report. That surely figured into Blackstone’s calculus on the HPP portfolio, where Netflix accounts for more than a third of all studio space rent.

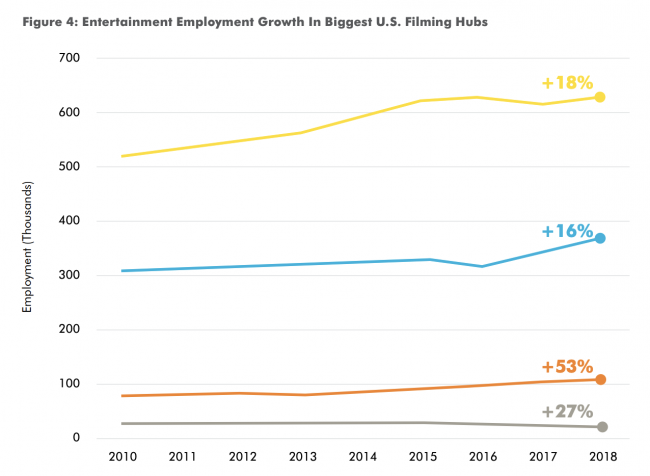

Video streaming has surged 74 percent over its level in 2019, when the top five streaming companies dropped $25 billion on new productions, according to the report. The growth in streaming has also fueled gains in entertainment-related employment over the last decade.

North America has 11 million square feet of soundstage space, mostly concentrated in Los Angeles, Atlanta and New York City. Los Angeles has about half of it, with 5.5 million square feet. Atlanta and New York follow, with 1.8 million square feet and 1.5 million square feet, respectively, according to the report.

Occupancy at spaces across North America has been north of 90 percent for several years, and the biggest markets are much more expensive because demand outstrips availability. Studios have alternatives, such as British Columbia in Canada (1.2 million square feet of soundstage space) and Louisiana (700,000 square feet).

Production studios also have sought space in emerging North America markets because of cheaper labor and favorable tax policies. Tax credits are easier to nab in emerging markets. Georgia, British Columbia and Ontario each offer transferable or refundable tax credits to film productions with no cap on the total tax write-off, according to the report. New York has a generous tax credit, at $420 million a year, but it is not unlimited.

Heightened demand for soundstage space is also driving many studios to rent “transitional” industrial spaces, according to the report. Over the last decade, conversion of industrial spaces into production facilities has grown more common.

Soundstage space is similarly versatile, which is one of the chief reasons for investing in it, according to Square Mile Capital’s Craig Solomon.

“We do not buy an asset that we don’t look to the alternative uses of that asset,” Solomon said in an October interview with The Real Deal. “It’s not expensive to reposition.”