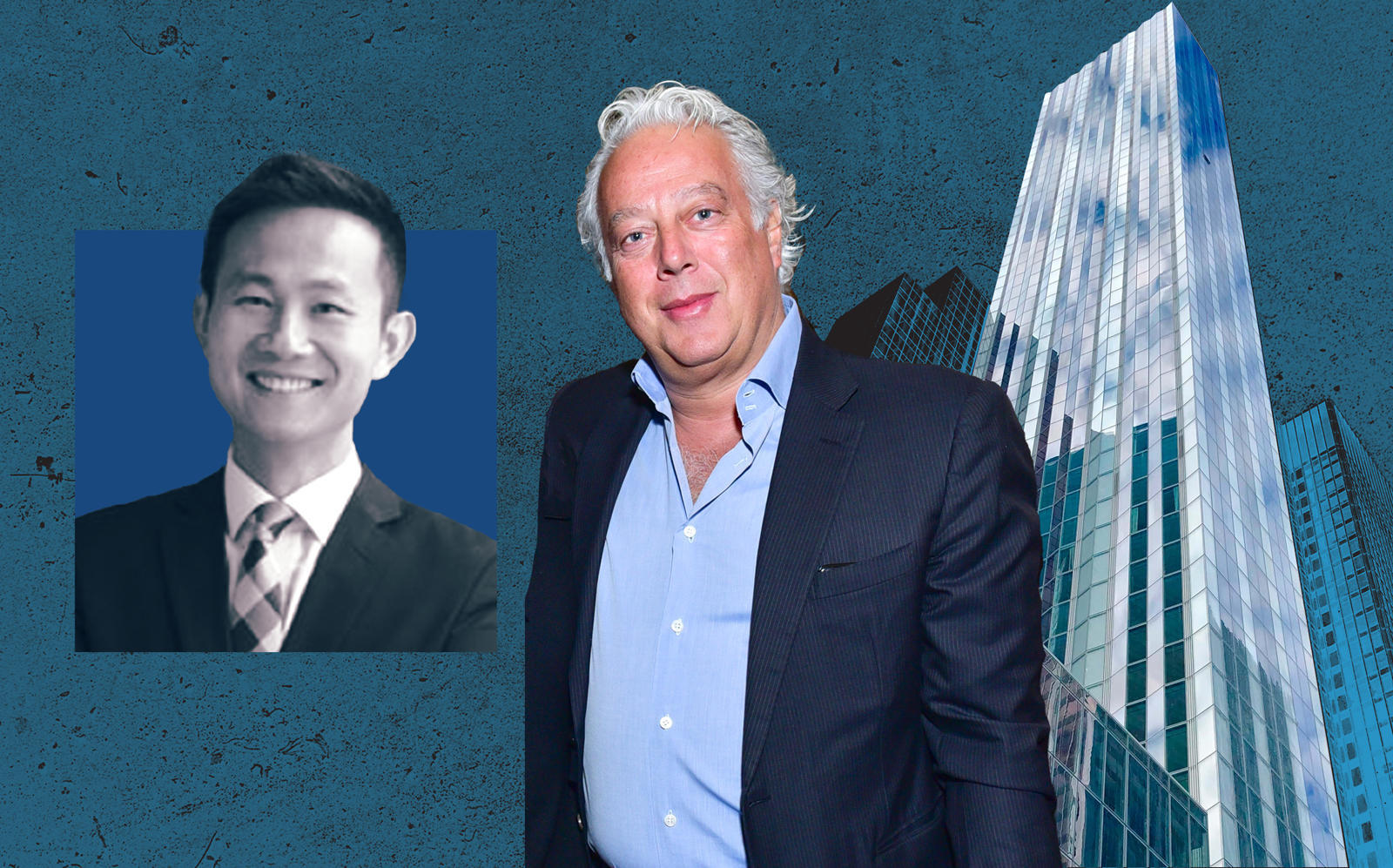

Aby Rosen accuses Chinese partner of “power grab” after condo loan default

Aby Rosen accuses Chinese partner of “power grab” after condo loan default

Trending

Vanke seeks to remove RFR from Midtown condo project

Aby Rosen’s firm wants “exorbitant buyout” of 7% stake, developer alleges

RFR Holding is using the pandemic as cover to extract an exorbitant buyout for its minority stake in a Midtown condo project, partner Vanke US has argued in a new court filing.

The allegations are in response to a lawsuit Aby Rosen’s firm filed last month, which accused Vanke, a U.S. subsidiary of one of China’s largest residential developers, of orchestrating a “backdoor deal” that put it on both sides of the borrower-lender relationship for the condo project at 100 East 53rd Street.

Rosen’s firm, “apparently having run out of the funds necessary to contribute to the success” of the project, “is seeking through its meritless lawsuit a continuation of its strategy to extract a buyout of the relatively small position it holds in the company,” Vanke alleges in its response to RFR’s complaint.

The partners secured a $360 million loan for the project from the Industrial and Commercial Bank of China in 2015, but it went into default this May. An entity controlled by Vanke owns a 93 percent stake in the project, while RFR controls 7 percent, according to the filing. Hines and China Cinda Asset Management are also partners in the 63-story, 94-unit development.

Read more

Aby Rosen accuses Chinese partner of “power grab” after condo loan default

Aby Rosen accuses Chinese partner of “power grab” after condo loan default

See it to believe it: Aby Rosen’s 100 East 53rd is banking on fresh momentum

See it to believe it: Aby Rosen’s 100 East 53rd is banking on fresh momentum

Vanke alleges that even before the pandemic hit New York, RFR had developed a strategy “to make the property seem distressed with hopes of gaining leverage with ICBC.” And coronavirus-related disruptions to the market — including a moratorium on foreclosures in New York — have contributed to those plans.

“RFR indicated that its strategy was to eventually force ICBC to foreclose and spend years in litigation (without any strategy for how it would actually defend a lawsuit) with the hope of negotiating a better deal with ICBC,” the filing says.

The developer also rejects RFR’s argument that it was not permitted to negotiate with ICBC. “In fact, RFR specifically requested that Vanke use its banking relationship with ICBC to encourage ICBC to act as its lender for the property,” according to Vanke, adding that RFR had also been given an offer to participate in the loan, but didn’t because the firm is “either unwilling or unable to invest further cash in this project” to finish it.

Vanke claims in its response that from last December to the present, it has contributed approximately $9 million in additional capital to the project, while RFR has contributed nothing. Compass, the co-exclusive sales and marketing agent for the Property, has resigned because of the lawsuit, and RFR has indicated that it will not approve any more unit sales, according to the filing.

RFR declined to comment to Commercial Observer, which first reported the filing. [CO] — Kevin Sun