The short-term dive in office demand is not likely to continue far into the 2020s, according to a recent report form MetLife Investment Management.

In fact, the cities where demand for office space is falling most — including San Francisco, Washington and San Jose — may attract the most demand over the next decade, presenting a “unique buying opportunity” for investors, the report says.

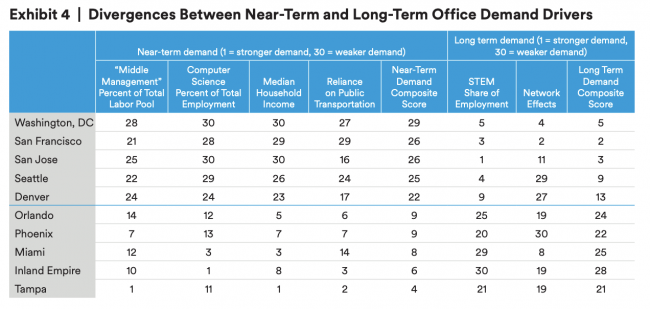

The report identifies pandemic-related trends that have led to the drop in demand for office space. Public transit is one factor: Until sometime next year, when a coronavirus vaccine could be widely distributed, MetLife says cities with workers who rely on public transportation might downsize their office leases. In New York City, for example, mass transit ridership is down 70 percent from a year ago (even though studies have found it poses a low risk for Covid-19) and only 13 percent of workers have returned to the office.

Offices in sprawling, car-centric cities such as Los Angeles, Miami and Dallas may fare better in the short term, and there may be greater demand for offices in suburban markets until a vaccine is widely distributed. But MetLife says the trend will likely reverse over the next decade, with firms returning to central business districts because they can tap bigger and typically more elite pools of talent.

Markets with a large share of high-income workers between the ages of 35 and 54 — what MetLife calls the “middle management” cohort — may also see office demand dip in the short term. “[T]he most junior and senior employees are less likely to work remotely and are also less likely to adopt desk-sharing arrangements that could allow firms to downsize office space,” the report reads. Employees who earn north of $100,000 work remotely more than lower-paid workers, per the report.

MetLife also expects office demand to fall less in cities where financial professionals make up a significant chunk of the workforce. Several major banks have announced extended work-from-home plans, and those working in finance are more readily able to work remotely than those in other white-collar professions. Yet they choose to work from home less often, according to MetLife’s research, which could help fuel healthier demand for office space.

Chart Source: MetLife Investment Management

Last month, Fitch Ratings issued a report stating that the rise of remote work and uncertainty about the future of the U.S. economy could hurt cash flow for office real estate investment trusts. In the report, Fitch projected office landlords’ operating incomes would fall over the next year before rebounding in 2022 and 2023.

But news that Pfizer’s coronavirus vaccine was more than 90 percent effective injected life into some office REITs earlier this month. Empire State Realty Trust, which owns the Empire State Building, saw its stock rise more than 37 percent the day Pfizer made its vaccine announcement. Moderna and AstraZeneca have since also reported promising results from trials for their own vaccines.