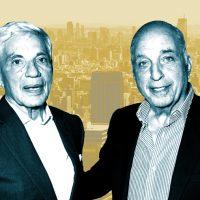

Joseph Chetrit and David Bistricer’s Clipper Equity have secured $207.5 million in fresh financing for their Gramercy Square condominium.

G4 Capital Partners provided the debt, which recapitalizes the 223-unit project, according to sources.

The deal comes after U.K.-based billionaires, the Reuben brothers, bought a $100 million piece of the existing debt on the building at a discount in May. SL Green Realty had originally provided a $380 million debt package in 2018.

Read more

G4’s managing partners Robyn Sorid and Jason Behfarin led the deal but declined to comment. Galaxy Capital Solutions brokered the deal.

The four-building project is a conversion of the former Cabrini Medical Center. Chetrit and Bistricer bought the parcel in 2013 for $150 million.

The condo plan was declared effective in 2018 with 40 units, or 18 percent of the project, under contract, according to the New York Attorney General’s office. The project’s targeted sellout is $834 million. Douglas Elliman is handling marketing and sales.

Clipper and Chetrit did not immediately respond to requests for comment.