HFZ sues CIM to halt condo foreclosure sale

HFZ sues CIM to halt condo foreclosure sale

Trending

Foreclosures tied to 4 HFZ condo buildings halted, for now

Judge ruled that CIM’s UCC foreclosure sales were “commercially unreasonable”

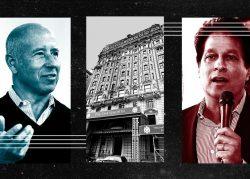

HFZ Capital Group scored a victory in a legal battle against its lender CIM Group — but the prolific condo developer isn’t out of the woods yet.

A New York Supreme Court judge ruled Thursday that CIM’s two planned foreclosure sales tied to four Manhattan condo buildings were “commercially unreasonable.” Still, CIM can go forward with a new UCC foreclosure sale if it meets certain conditions.

HFZ had filed a lawsuit on Nov. 11 to stop the sale of four mezzanine positions that was scheduled for the following day. CIM Group then sought to hold another sale on Nov. 17. Both sales were delayed when judges granted HFZ temporary restraining orders.

Read more

HFZ sues CIM to halt condo foreclosure sale

HFZ sues CIM to halt condo foreclosure sale

HFZ loses stake in national warehouse portfolio

HFZ loses stake in national warehouse portfolio

Starwood suing HFZ for $157M over co-op conversion loan default

Starwood suing HFZ for $157M over co-op conversion loan default

Latisha Thompson, an attorney with Morrison Cohen who represents HFZ, said there is currently no date or timeline for when a new foreclosure sale will occur.

The sale could have allowed either CIM or a new investor to ultimately take control of the four condo conversion projects: 88-90 Lexington Avenue, The Astor at 235 West 75th Street, and Fifty Third and Eighth at 301 West 53rd Street. CIM held four junior mezzanine loans with a balance of $89.5 million that had equity interests in the four condo projects.

HFZ and its lender had been negotiating loan modifications over the summer, but the developer claims that CIM had no intention of restructuring the loans. Instead, HFZ alleges CIM planned to make a “credit bid” at the auction, which would allow the lender to take control of the collateral of the properties. (The credit bid would allow CIM to make a bid with the debt that HFZ owes).

CIM nor its attorney Gary Mennitt at the law firm Dechert returned requests for comment. HFZ did not immediately return a request to comment.

The judge said that CIM’s foreclosure sale “created confusion in the marketplace,” and required an “unreasonably high deposit to qualify to bid.” The judge also said it was unreasonable that CIM grouped the four properties to sell in one package rather than selling the four property interests individually or as a package that could maximize the value of the collateral.

In order for CIM to go forward with a foreclosure sale, it has to provide HFZ access to the database that contains information about the sale.

HFZ is seeking to recover damages from the planned auctions. The next hearing is scheduled for January.

In July 2013, HFZ, led by Ziel Feldman and Nir Meir, paid Westbrook Partners $610 million for the four properties, teaming up with Fortress Investment Group on the buy. The portfolio consisted of 743 rental units, and the partners began the process of converting the buildings into residential condos. JPMorgan and Oaktree Capital led a $500 million refinancing of the four properties in 2016.

The New York-based condo developer is facing financial challenges with a number of lawsuits by lenders and contractors over unpaid bills.

Starwood Capital Group alleges in a suit that HFZ defaulted on a $157 million loan on the Chatsworth, a co-op conversion at 344 West 72nd Street. Earlier this month, Chicago-based credit investor Monroe Capital took control of HFZ’s equity stake in a portfolio of 12 last-mile warehouse properties.