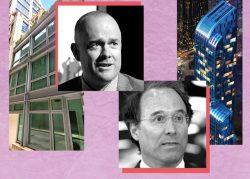

As Manhattan’s luxury market rallies, billionaire Barry Sternlicht has agreed to sell his West Village pad.

The founder and CEO of Starwood Capital Group was asking $40 million for his five-bedroom condo at 150 Charles Street when it went into contract last week, according to Olshan Realty’s weekly report. The executive bought the roughly 5,700-square-foot unit overlooking the Hudson River for $34.4 million in 2016 through limited liability company, BSS CHARLES STR, Olshan reported. The buyer is unknown.

Read more

Sternlicht’s condo was the most expensive deal inked last week out of 17 luxury contracts that made Olshan’s report, which tallies Manhattan deals for homes last asking $4 million or more. A representative for Sternlicht did not respond to a request for comment.

Though last week represented a decline in luxury contract activity compared to the prior week’s 23 deals, the borough’s quarterly sales volume for homes of all sizes passed the year-ago level.

With two weeks left in December, sales volume of residential contracts above $4 million signed in the quarter was $1.87 billion, compared with $1.78 billion recorded for the entire fourth quarter of 2019.

“There was light at the end of the tunnel with the fourth quarter results,” said Donna Olshan, the report’s author, in an interview.

But pointing to the city’s Covid infection rates, which has risen fivefold from its summer low, and the looming specter of a pied-à-terre tax, Olshan said it’s impossible to know whether the uptick will continue.

“We’re going into a very dark phase of the winter now and we just don’t know what’s going to happen,” she said. “I’m not going to come out and say we are going to hit the salad days anytime soon.”

The second priciest luxury contract signed last week in Manhattan was for a townhouse at 132 East 70th Street on the Upper East Side. The five-story home has an elevator and the bottom two floors are zoned for commercial use. It went into contract asking $9.7 million after years on the market. The asking price was as much as $20 million in 2017.

Across the 17 luxury contracts signed last week, the average discount from the original to the final asking price was 12 percent. The average time on market was 297 days and median asking price was just under $5 million.

Correction: A previous version of this article stated that the fourth quarter sales volume included all contracts signed in Manhattan. In fact, the figure only includes luxury contracts signed above $4 million.