Appraisal cuts Kushner Companies’ Times Square retail value 80%

Trending

What appraisal reductions mean for future losses on CMBS loans

Number of reductions surged from 111 to more than 400 in 2020

As delinquency rates for commercial mortgage-backed securities settle into a new normal after early pandemic chaos, other market metrics give an indication of more struggles to come.

One such data point is appraisal reduction amounts, which come into play when a CMBS loan encounters a triggering event such as serious delinquency or insolvency. The calculation of a loan’s ARA is determined not only by the appraised value of a property, but also by factors such as the unpaid loan principal balance and reserve funds.

There were 111 outstanding CMBS loans with ARAs at the end of 2019, but by November 2020, that figure had ballooned to 409, according to a new report from Kroll Bond Rating Agency.

“Based on the prevailing economic environment, the lag effect of commercial real estate performance to the general economy, and since 90 percent of delinquent and specially serviced loans do not have ARAs, we anticipate the absolute dollar volume of ARAs will continue to rise through 2021,” Kroll analysts wrote.

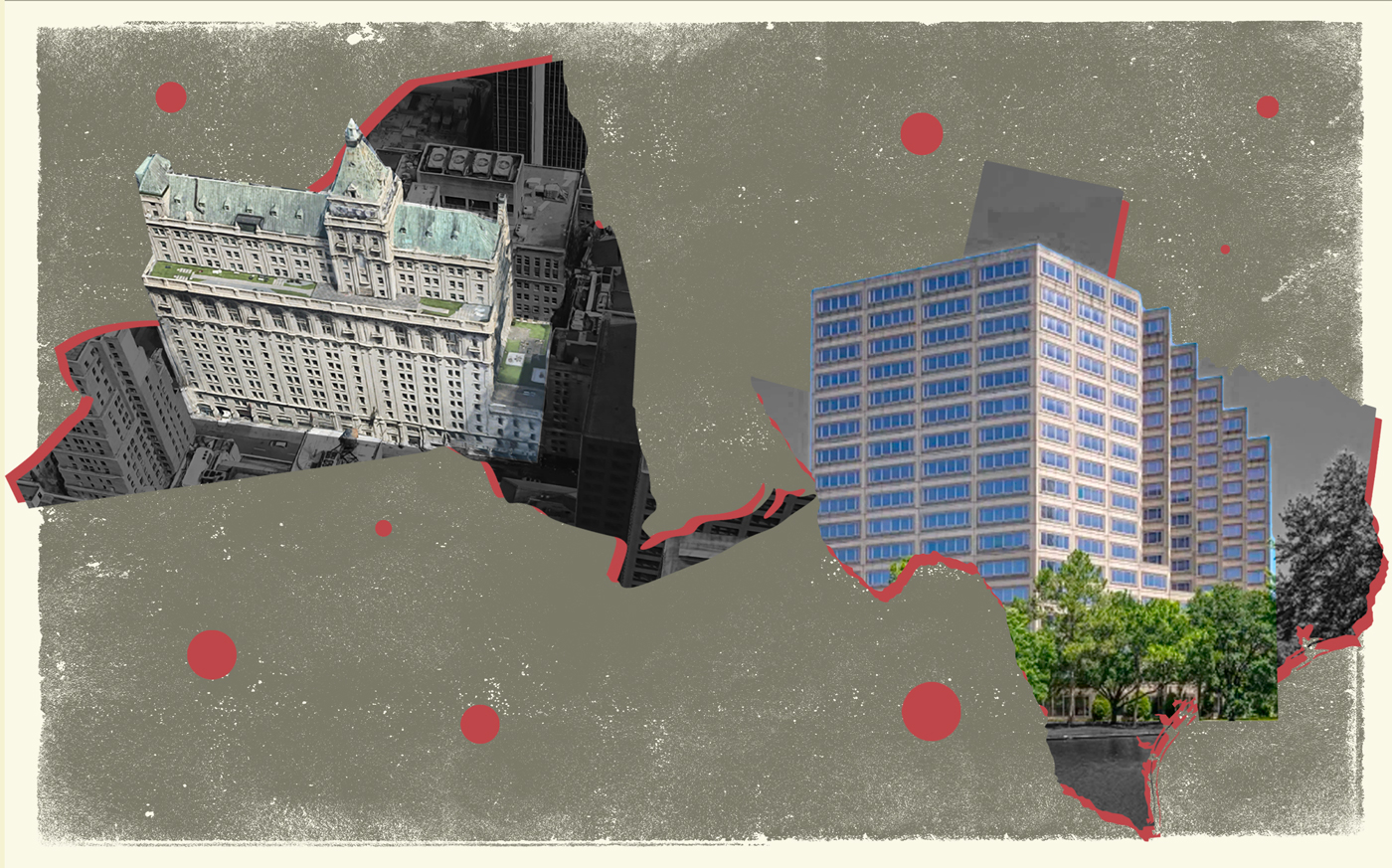

The largest outstanding appraisal reduction is on a Kushner Companies property: a 250,000-square-foot retail condo at 229 West 43rd Street in Times Square, which has been under financial stress since before the pandemic and saw its value slashed from $470 million to $92.5 million in August.

Retail in general has been one of the hardest hit sectors, with 156 outstanding loans saddled with appraisal reductions totaling $1.7 billion. As the table below shows, the lodging sector has a larger number of loans facing reductions, although its total reduction amount is significantly less.

Appraisal reductions can impact CMBS bondholders in a number of ways, per Kroll. They lead to reductions in the amount of principal and interest payments that servicers are required to advance, resulting in shortfalls for subordinate certificate holders. This can also cause control of the CMBS transaction to shift to a more senior class.

After New York, Texas is the state with the largest exposure to loans with appraisal reductions, according to the report. The reductions there are dominated by a pair of office buildings in Houston’s Energy Corridor, which have suffered from downsizing in the oil industry and new supply in the area. Two Westlake Park has seen its appraised value fall from $124 million to $24 million, while Three Westlake Park has gone from $121 million to $38 million, according to Trepp.

Read more

A tale of two markets: Some CMBS players see huge losses, others opportunity

According to Kroll’s analysis, about half of all appraisal reductions effectuated in the past two years seem to have been “automatic,” meaning that an updated appraisal was not received within the specified 30-60 day timeframe, so that an ARA value equal to a quarter of the loan’s unpaid principal balance was applied by default.

A historical analysis found that appraisal reductions were a good predictor of eventual losses. Of 59 loans disposed between 2014 and 2019 that had non-automatic ARAs, 44 ended up with realized losses that were larger than their initial reduction amounts.

Still, “[w]hile a historical perspective may give some guidance, in these uncertain times, past results may not predict future losses,” the analysts note.