Signature Bank, one of the city’s most active multifamily lenders, saw an increase in income and a decrease in loan deferrals in the fourth quarter.

The lender’s net income totalled $173 million, up from $148 million during the same period in 2019. Net income for the year was down, at $528 million, versus $586 million in 2019.

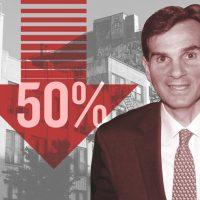

Though an improvement, nearly 9 percent of the bank’s $49 billion loan portfolio remains in some sort of deferral. That’s a decrease from $9.4 billion in the third quarter and the peak of $11 billion in July 2020. But $1.3 billion in loans — 2.7 percent of its overall portfolio — have paused both principal and interest payments. Another 6.6 percent of the bank’s loans have been “modified,” primarily by allowing borrowers to pay interest-only for between six and 12 months.

Read more

At $15 billion, the bank’s multifamily holdings account for 30 percent of its loan book. Nearly $615 million of those loans are in deferral, the bank reported.

The bank also holds $6 billion and $4 billion in retail and office loans, of which 6.5 percent and 3.8 percent are in deferral, respectively.

Despite those figures, Joseph DePaolo, president and CEO, emphasized the bank’s confidence in those loans’ long-term outlook.

The bank’s multifamily borrowers aren’t looking to give up their buildings, he said, because most of those assets are still performing — although industry groups have reported that rental arrears are soaring in some New York City apartments. A trade association which represents landlords said that as of January, 185,000 households are now two months’ behind on rent. Signature says its clients, however, have been more fortunate, and are prepared to endure what it considers a temporary decline in rent collections.

“The type of clients we have are not those who have one building and rely on that one building for their livelihood,” said DePaolo. “We have large clients that have multiple buildings, and while some may be hurting, most are not.”

Borrowers who are getting a break on principal and interest payments are still paying operating expenses, insurance and taxes, he added. Property tax payments have so far remained steady in New York City, although the city has taken a hit from the sharp decline in transaction taxes.

In addition to its regular operations, Signature has had to contend with its connection to President Donald Trump amid the turbulent end to his term. The bank’s share prices have risen steadily since Nov. 6, surpassing its pre-pandemic levels for the first time since the onset of the coronavirus.

The bank has made a concerted effort to distance itself from the twice-impeached former president, who faces ongoing investigations into his company’s business practices.

After the Jan. 6 capitol riot, Signature said it would close Trump’s personal bank accounts, which held about $5.3 million. In a statement, the bank also called for Trump’s resignation.