E&M Management, once one of New York City’s largest landlords of rent-regulated apartments, is selling its massive Hudson Valley portfolio for more than $100 million.

A partnership of multifamily firm Aker and investment firm Pearlmark closed on four of the firm’s properties for $81 million, which is $26 million more than E&M purchased them for, sources told The Real Deal. The buyers raised $21.8 million on the commercial real estate crowdfunding platform Crowdstreet.

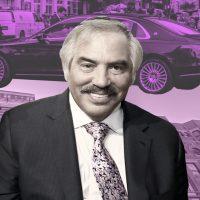

Those four properties, which have approximately 500 units, are clustered around Kingston, an area that has seen significant interest — and rising prices — in recent years. Together with its other holdings in the area, the properties made E&M one of the largest landlords in Ulster County. They were jointly owned by E&M Management’s Irving Langer and Daniel Goldstein, who each held a 50 percent stake.

Those four properties are located at 30 Black Creek Road in Highland; 557 Broadway in Port Ewen; and 305 Hurley Avenue and 111 Hudson Valley Landing in Kingston. The Kingston Waterfront property includes 67 existing units, with approvals to develop 54 more apartments and 11,000 square feet of commercial space. E&M acquired the portfolio between 2016 and 2019.

A fifth property, the 217-unit Sunset Gardens at 45 Birch Street, is being sold separately, and is in contract at $34.5 million.

E&M declined to comment. Aker and Pearlmark did not return requests for comment.

Read more

Sources with knowledge of the deal said that the Kingston sale was in part precipitated by Langer’s need to pay outstanding debts to Churchill Real Estate. Last year, he scrambled to secure $26 million in financing for a bridge loan on a 3,000-unit rent-regulated multifamily portfolio.

E&M successfully fended off an attempt in 2019 to place some units in the portfolio under rent regulation, after changes to the law at the state level made it a possibility. The high rate of turnover at the Kingston Village complex, which would have been vulnerable to such a conversion, stymied the local rent control effort.

All of the units are currently market-rate, and according to marketing documents, the buyers plan to renovate more than half of the apartments over a 32-month period, raising rents an average of $428. According to the marketing materials, the new owners plan to sell the properties to the next buyer with “meat on the bone” — i.e., the possibility of raising rents further.

Prior to E&M’s acquisition of the properties, they were owned by Bob Morgan, who the SEC accused of running a “Ponzi-scheme like” scam through his buildings. The charges were ultimately settled.

Peter Wolf of Select Real Equity Advisors, who brokered the transaction for the seller, said that interest in the area has increased dramatically since the 1990s. The marketing materials on Crowdstreet tout the portfolio’s proximity to New York City and the influx of restaurateurs fleeing high rents, which started before Covid-19. Inflows to the once-quiet Hudson Valley town have since intensified, according to the documents, making Kingston a particularly desirable destination for people who left Manhattan since the outbreak of coronavirus.