An Amazon-leased warehouse in Brooklyn sold for a valuation of $46 million as investors continue to chase properties occupied by the e-commerce giant.

Asset manager BentallGreenOak purchased the 100,000-square-foot property at 2300 Linden Boulevard in East New York from Turnbridge Equities and Harbor Group International, a source familiar with the sale told The Real Deal.

BentallGreenOak, headed by CEO Sonny Kalsi, paid $460 per square foot for the property, where Amazon inked a lease last year. The e-commerce giant signed on to use the property as a delivery station over a 10-year term.

Read more

Representatives for BentallGreenOak, Tunbridge and Harbor Group could not be immediately reached for comment. A Cushman & Wakefield team led of Adam Spies, Adam Doneger, Kevin Donner, Marcella Fasulo and Gary Gabriel negotiated the sale. A representative for the brokers declined to comment.

Midtown-based Turnbridge Equities and Harbor Group acquired a ground lease on the warehouse in 2018 for $4.4 million, with an option to purchase the ground underneath the property. The companies reportedly planned to spend $3 million renovating the property.

BentallGreenOak acquired the ground lease and will exercise the purchase option, sources said, bringing the valuation to $46 million.

The long-term lease with Amazon, which zeroed in on the warehouse due to its proximity to John F. Kennedy International Airport, helped boost the property’s value.

In fact, properties leased to the giant are trading at a premium. Amazon-leased properties in the New York City area have experienced notable capitalization-rate compression over the past 12 months, according to data from Cushman & Wakefield’s Industrial Group.

That means buyers are willing to pay higher prices and accept lower returns on those investments, which can often be financed under attractive terms thanks to Amazon’s top-quality credit ratings. Amazon-leased properties in the area have been trading at cap rates somewhere between 50 and 100 basis points lower comparable ones in other parts of the country, according to Cushman’s figures – an indication of high demand.

Despite the strong headwinds for the last-mile logistics and warehousing sector, the industrial market couldn’t escape the pandemic woes that shook New York City’s investment sales market in 2020.

The city recorded 95 industrial sales last year, down 40 percent compared to 2019, according to a year-end report from B6 Real Estate Advisors.

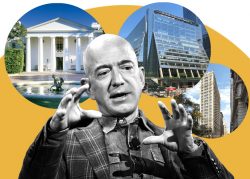

Amazon founder Jeff Bezos announced Tuesday he would be stepping down as CEO of the company and taking over the role of executive chairman. Andy Jassy, who runs the company’s cloud-computing division, will take over the CEO job.