Like most retailers, merchants in Midtown Manhattan’s Diamond District have had to grapple with the impact of the pandemic over the past year. But gem deals are still getting done — to the tune of $400 million per day, according to a Bloomberg News estimate from last summer.

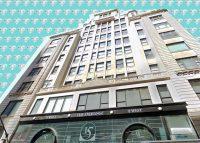

It’s not just jewels that are trading hands in the neighborhood. In December, the ELO Organization closed on its $110 million acquisition of the Chetrit family’s 15 West 47th Street, an 18-story, 130,000-square-foot office building that went into contract shortly before the pandemic.

At the same time, ELO closed on $141 million in CMBS debt from Citi Real Estate Funding, not only to finance the acquisition but also to refinance two nearby properties: the 140,000-square-foot 48 West 48th Street, and the 66,000-square-foot 151 West 46th Street, both of which the firm has owned since 2001.

Documents associated with the securitization provide an inside look at a cross-section of the District’s roughly 2,600 independent jewelry businesses, whose ties to New York real estate sometimes extend well beyond the leases they sign.

As of November, the three properties were 95 percent leased to 242 office tenants and 48 retail tenants, most of which are “jewelry-related tenants, such as vendors, appraisers, and repairmen, which traditionally sign short-term lease agreements with minimal to no concession packages,” according to an S&P rating report.

Most of the jewelry tenants occupy suites with sizes ranging from 100 to 5,100 square feet. The newly acquired property at 15 West 47th Street features an 8,700-square-foot “open-floor jewelry exchange” on the ground floor with 34 individual booths of 250 square feet each, subject to a master lease that extends through 2049.

Given the small size of most individual jewlers, the top of the portfolio’s rent roll is dominated by restaurants. The tenant that pays the most is Cuban bar and restaurant Havana Central, which has been at 151 West 46th Street since 2004. The second biggest tenant is 24-hour fast-casual eatery Delis 48, at 48 West 48th Street.

Read more

At the beginning of the pandemic, ELO offered tenants at the 46th and 48th Street properties one or two months of rent concessions on a case-by-case basis, which were not required to be repaid. Tenants at the 47th Street property, which was still owned by the previous landlords at the time, were offered rent deferrals that had to be paid back.

Rent collections in the portfolio dropped to 79 percent last March and bottomed out at 15 percent in April, but have since rebounded to above 100 percent (which includes repayment of back rent) as of November. The buildings are open and operating in accordance with city guidelines, according to S&P.

Headed by Jack Elo, the ELO Organization has also been an active buyer elsewhere in Manhattan, having acquired two Garment District buildings for $37.3 million in 2016.

A few doors down from the firm’s latest acquisition, ELO is currently involved in a legal dispute with Extell Development over that firm’s plans to build a 534-key hotel at 32 West 48th Street. Gary Barnett’s firm alleges that ELO has interfered with the development in an effort to preserve its “illegal lot line windows” at 29 West 47th Street.