The commercial mortgage-backed securities market continues to be a big source of refinancings for Manhattan office properties.

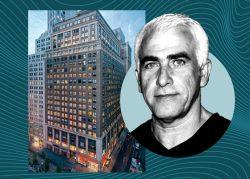

CIM Group has secured a $400 million refinancing for the 740,000-square-foot office building at 1440 Broadway near Times Square, Commercial Observer reported. The $300 million A-note is being securitized by JPMorgan into a single-asset CMBS transaction, while a $100 million B-note is held by Oaktree Capital.

CIM acquired the property for $520 million in 2017 as part of New York REIT’s liquidation. According to CMBS rating documents published last week, a majority stake in the 25-story building is owned by QSuper, an Australian pension fund based in the state of Queensland.

Read more

The new owners have increased occupancy at the property from 50 percent to 93 percent since acquiring it, with WeWork leasing 236,000 square feet, or about 40 percent of the building. The WeWork space is mostly leased to two Fortune 500 enterprise tenants.

Among other tenants, Macy’s and Mizuho Capital are currently marketing all of their space at 1440 Broadway for sublease, while Kate Spade has already subleased all of its space to two other companies.

The ground-floor retail is anchored by a CVS. A cafe and a Mexican restaurant at the property have been closed due to pandemic.

Rating documents show that the CMBS loan includes $30 million in upfront reserves, most of which is to be used on leasing costs, and the borrowers are required to contribute another $20 million in equity.

[CO] — Kevin Sun