In June 2019, a judge ruled in favor of tenants at two Lower Manhattan buildings, finding that their apartments should have been rent stabilized under the 421g tax program.

In both cases, the landlords — Clipper Equity and an entity tied to Kibel Companies — were found to have deregulated units at buildings they own that have received the 421g tax break. In its ruling, the court decided that the legislature’s intent to ensure that apartments were regulated during the life of the tax break was “clear and inescapable.”

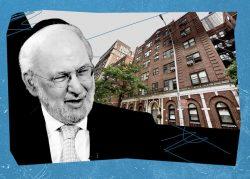

But now, Clipper Equity is facing another lawsuit from a tenant at 50 Murray Street, the building in question in the first complaint, who alleges that the landlord has been charging more than what she claims is the legal, rent-stabilized rate for her apartment.

Read more

In a complaint filed in New York State Supreme Court, Heather Horn alleges that Clipper Equity never informed her that her apartment was subject to the state’s rent stabilization laws, nor was she given a rent stabilization rider for her lease when it was signed. Instead, she has paid market-rate rent and her lease has repeatedly been renewed as such, with rents going from $4,695/month in 2014 to $5,900/month in 2020.

“Defendant, its members, officers, employees and agents, knew or reasonably should have known, that the provisions of high rent vacancy deregulation and high rent, high income deregulation did not apply to buildings receiving 421-g tax benefits,” the lawsuit reads.

Neither Clipper Equity nor attorneys for Horn responded to requests for comment.

At the time of the 2019 lawsuit, lawyers for Clipper Equity argued that because the Rent Stabilization Law of 1993 didn’t specifically exempt 421g — although it did exempt the 421a and J51 tax breaks — that apartments covered by the break could eventually return to market-rate.

The 421g break was enacted in the 1990s to encourage the conversion of office buildings to residential ones. Buildings that receive the tax break are entitled to various benefits, such as a construction period exemption and an abatement of real estate taxes.