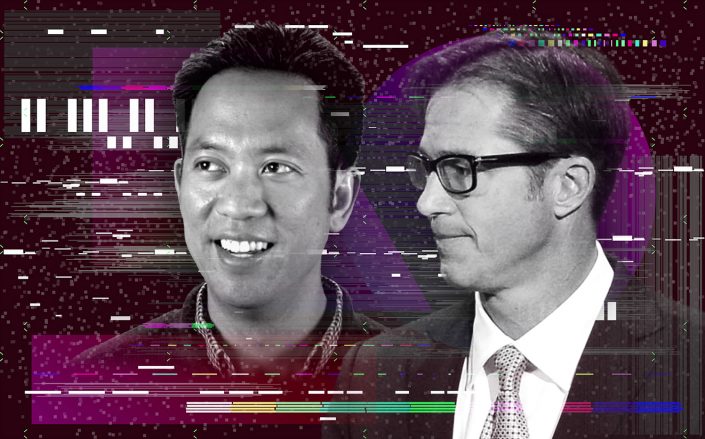

Opendoor CEO Eric Wu and Zillow CEO Richard Barton (Wu via Resolute Ventures, Barton via Getty)

The big iBuyer experiment continues to be very, very costly.

Opendoor and Zillow lost a combined $1.2 billion buying and selling homes over the past two years, including $607 million in 2020, according to a new analysis from industry observer Mike DelPrete.

“That’s a loss of about $40,000 on each home bought and resold — about $1.6 million every single day or $1,100 per minute in 2020,” he wrote in a report published Wednesday.

Instant homebuyers, a nascent part of the housing market, use algorithms to purchase homes directly from sellers, and then resell at a slight premium. Zillow got into the business in 2018, when CEO Rich Barton said not doing so would pose an “existential” threat to its business. Opendoor, the industry leader, went public last year in a merger with a blank-check firm backed by Chamath Palihapitiya.

Read more

Both companies paused homebuying last spring, however, and their recovery has been slow, DelPrete noted. Opendoor reported a 45 percent drop in 2020 revenue after selling fewer homes. In DelPrete’s analysis, Opendoor’s net loss per home topped $100,000 last year.

But he said Opendoor’s 15.4 percent gross margin is a positive sign. Holding costs and interest expenses are also down for both companies. Opendoor lowered its selling costs to 2.1 percent from 3 percent, he said.

Last month, Zillow said its 2020 revenue surged 22 percent thanks to the hot housing market. After suspending home-buying during the first half of the year, the company lost $162 million, down from $305 million. As it rebuilt its inventory during the fourth quarter, Zillow bought 1,789 homes and sold 923.

Opendoor, which sold off $1 billion worth of inventory during the lockdown, is also in rebuilding mode. Earlier this month, it said it owned 1,827 homes valued at $466 million.

Despite the iBuyers’ “staggering” losses, DelPrete said Zillow and Opendoor remain “staunchly pro-consumer” by streamlining the experience, lowering fees and bundling services including title and mortgage.