Last week, Manhattan’s luxury residential market had its best week since March 2013, thanks to three large deals that went into contract.

The top deal was the renovated Upper East Side mansion owned by billionaire Vince Viola, which reportedly sold for $28 million below ask, followed by two condos in Robert A.M. Stern buildings: a penthouse at 15 Central Park West and the first resale at 220 Central Park South.

The three deals were the priciest of Manhattan’s 38 contracts signed on properties asking $4 million or more last week, according to Olshan Realty’s weekly report. It marked “another amazing week” to Donna Olshan, the report’s author, and was the sixth consecutive week that more than 30 luxury deals were signed.

The total dollar volume of those 24 deals was $419.6 million, with the top three deals helping to push that figure to the highest it’s been since 2013.

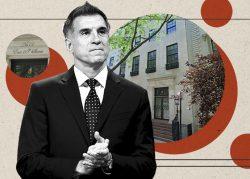

Viola’s 20,000-square-foot home at 12 East 69th Street was once listed for $114 million, but has gotten a series of price cuts over the years. Iit finally went into contract last week asking $79 million, though the Wall Street Journal reported the final sales price was actually closer to $60 million. It was renovated to include an indoor swimming pool, gym, duplex cinema and a panic room.

A sprawling duplex at 15 Central Park West was the second most expensive contract inked last week. The home, which overlooks Central Park, includes its own elevator entryway, a 1,000-square-foot terrace, gas fireplace and library. It was last asking $57.9 million, down from the $65 million it was initially listed for.

Coming in third was the first resale at 220 Central Park South. The 3,211-square-foot three-bedroom unit went into contract on Friday for $33 million.

The majority of last week’s deals, 24, were condos and 14 were sponsor units. The average discount between first ask and final ask was 9 percent with the properties spending an average of 603 days on market.

Read more