The Wolkoff family’s real estate firm snagged $350 million in financing from JPMorgan Chase for its apartment project at a Long Island City site made famous by graffiti.

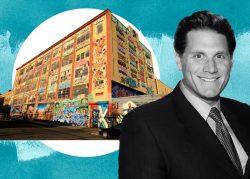

G&M Realty secured the financing for 5Pointz, its 1.3 million-square-foot, mixed-use development at 22-44 Jackson Avenue, according to property records. The project will have more than 1,100 apartments.

The money will refinance a $300 million construction loan obtained from Bank OZK in 2018.

Read more

The father-son duo Scott and Andy Singer of the Singer and Bassuk Organization arranged the financing, as they had in 2018 as well.

Andy Singer said the project recently secured its temporary certificate of occupancy and in a few weeks residents will be able to move in.

The site was once home to a former water-meter factory that Wolkoff Group’s founder, the late Jerry Wolkoff, purchased in the 1970s. Over the years, 5Pointz turned into a mecca for graffiti artists (or vandals, as some might describe them) from around the world and became known as the “Institute of Higher Burnin.”

That changed one night in 2013 when Wolkoff had the site painted over, leading to backlash from artists.

A judge ordered Wolkoff to pay a group of them $6.75 million in damages in 2018. Wolfkoff’s development firm appealed the decision, but gave up on the case when the U.S. Supreme Court denied a petition to revisit the ruling last October.

Jerry Wolkoff died last summer at age 83 after a brief neurological disorder. His son David is now in charge of the company’s 5Pointz development.

Long Island City has seen a wave of new apartment buildings offering cushy amenities and waterfront views.

In 2018 the real estate marketplace Localize.city reported that 6,400 residential units would be coming to Long Island City in 2020, the most of any neighborhood in the city. But Covid stymied demand, and the number of new leases signed in northwest Queens, which includes Long Island City, declined every month for more than a year until recently, according to data from Douglas Elliman.

Some of these complexes have seen occupancy tumble during the pandemic. At Tishman Speyers’ 1,871-unit Jackson Park, occupancy fell from 96 percent in 2019 to 59 percent as of September, according to Trepp, which tracks mortgage back securities.

Nearby, RockRose Development’s 715-unit Linc LIC, at 43-10 Crescent Street, saw occupancy decline from 91 percent in 2019 to 67 percent in the third quarter of 2020.