Signature Bank saw record earnings and deposit growth last quarter, but also some red flags.

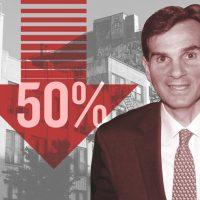

Loan modifications related to Covid-19 rose to 7.1 percent of its loan book, up from 6.6 percent in the fourth quarter, Crain’s New York reported.

It’s a sign that the property lender’s borrowers are struggling as the pandemic continues. Signature held $3 billion of troublesome loans rated “special mention” or “substandard,” compared to $1 billion as of Sept. 30, the publication said.

Commercial property and apartment loans make up more than half of the company’s $50 billion portfolio, according to Crain’s. Signature Bank defines modified loans as those where interest but not principal is paid, and they aren’t classified as deferred.

Read more

The ominous signs loom as the bank celebrates what chief executive Joseph DePaolo called an “unbelievable quarter” with record earnings and deposit growth, the publication reported.

The bank is involved in the cryptocurrency market, with financial technology company Circle saying that Signature bank would hold billions in deposits related to USD Coin, the report added.

Signature Bank’s stock price jumped 12 percent when the quarterly earnings were reported and has nearly tripled in the past 12 months.

[Crain’s New York] — Cordilia James