Bulk condo deal leads Manhattan’s mid-market i-sales

Bulk condo deal leads Manhattan’s mid-market i-sales

Trending

Manhattan office properties trade at a discount

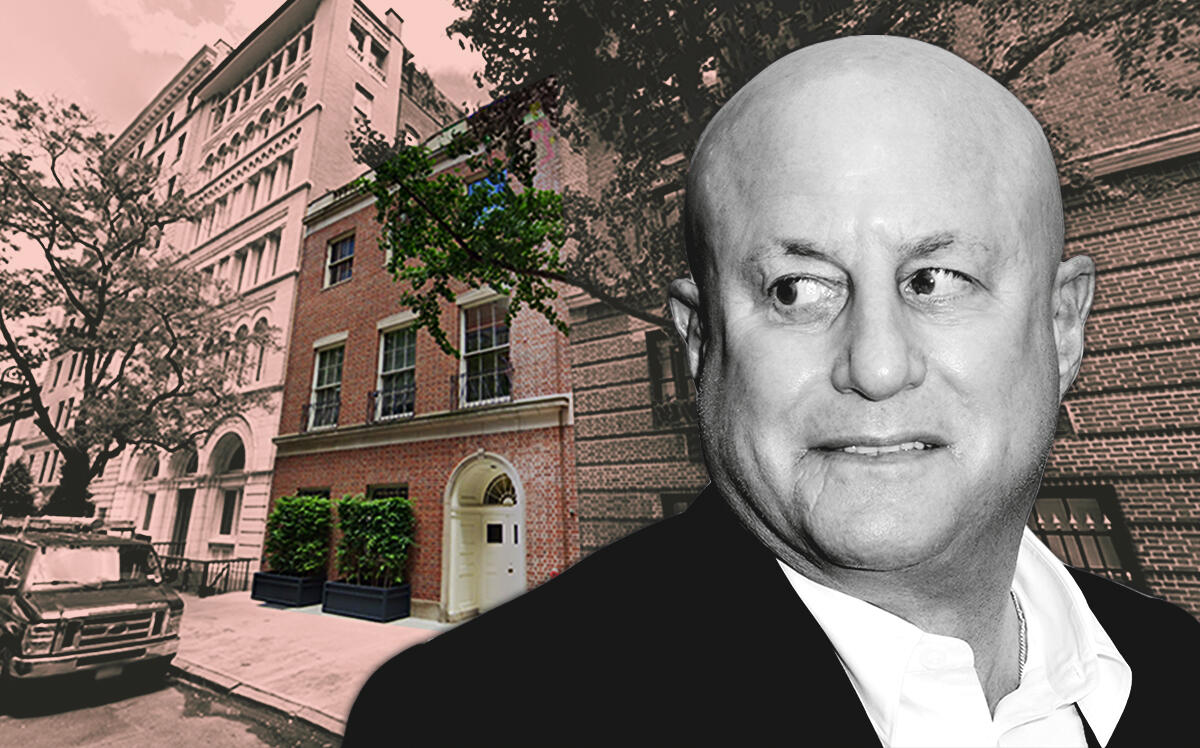

Ron Perelman’s office sales topped this week’s mid-market investment sales

The biggest mid-market deals of last week — defined as ones that closed for between $10 million and $30 million — were office properties, with billionaire businessman Ron Perelman’s sale of two Lenox Hill buildings topping the list. Rockrose also bought a chunk of an office building that values the property at a slight discount from its pre-pandemic valuation.

There were four deals for the week ending April 23, which generated $90.45 million, handily beating the previous week’s total of $29.25 million. Three of those deals were in Manhattan, with a fourth — Kushner Companies’ sale of a retail condo and parking garage space — in Williamsburg.

Here are more details on those mid-market deals:

1. Ron Perelman’s MacAndrews & Forbes sold a 15,200-square-foot office building at 39 East 62nd Street in Lenox Hill for $10 million — a substantial discount from what he paid for it — and an adjacent office building at 35 East 62nd Street, spanning 19,200 square feet, for $25 million. The Chapman Group, a family-owned real estate firm, bought the buildings.

2. Rockrose Development purchased a 14 percent interest in a 218,000-square-foot office building at 11 East 26th Street in Nomad for $32.9 million. The deal values the building at $235 million, down slightly from a pre-pandemic valuation of $246 million. Edward Traum signed for the buyer. The seller was 11-13 E. 26 St. Holding. Rockrose owns the adjacent building at 15 East 26th Street.

Read more

Bulk condo deal leads Manhattan’s mid-market i-sales

Bulk condo deal leads Manhattan’s mid-market i-sales

Manhattan, Elmhurst notch $83M in mid-market sales

Manhattan, Elmhurst notch $83M in mid-market sales

3. Rockpoint Group and Kushner Companies sold a 16,000-square-foot retail condo and 55,000 square feet of parking garage space at 184 Kent Avenue in Williamsburg for $11.7 million total. A joint venture between Regal Acquisitions and the limited liability company Jackson Group was the buyer. Rockpoint and Kushner provided the seller with financing. Matthew Marshall of Marshall Real Estate brokered the transaction.

4. Co-living firm CSC purchased a 48,000-square-foot church at 41 East 129th Street in Harlem for $10.85 million. The seller was the Roman Catholic Church. Sal Smeke signed for the buyer.