Five mid-market investment sales were recorded in the city last week for a total of $103.6 million, smashing the previous week’s total of just $39.6 million.

Of those, the three biggest deals were for office buildings, including one with development potential in Midtown. Two of the five deals were located in Manhattan; another two were in Queens; and the Bronx rounded out the list.

The Real Deal defines mid-market deals as those between $10 million and $30 million. Here are more details for the week ending May 14.

1. GDSNY and Klövern acquired a 4,300-square-foot retail building at 407 Park Avenue in Midtown for $30.7 million. The seller was Washington, D.C.-based Land Finance, which bought property for $8.7 million in 2010. The partners plan to combine the parcel, which has 32,000 square feet of development potential, with an adjacent parcel at 417 Park Avenue for an office project. Together, the two properties have more than 250,000 square feet of buildable space.

2. Ivy Realty sold a 260,000-square-foot office building at 133-33 Brookville Boulevard in Rosedale for $29.5 million. Anthony DiTommaso, Jr. signed for the seller, while Joel Kiss of Northeast Capital Group signed for the buyer. The purchase included seven adjacent lots that are used for parking.

Read more

3. Steven Kassin’s Infinity Group bought a 25,333-square-foot retail and office building at 55-03 Myrtle Avenue in Ridgewood for $17.5 million. The seller was Traditional Casket Corp.

4. The Atlantic Development Group purchased a 37,000-square-foot parking structure at 1949-1961 Jerome Avenue in Morris Heights for $13.9 million. The seller was Tremont Garage Realty Corp.

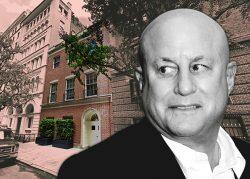

5. A limited liability company purchased a 13,500-square-foot mixed-use building at 300 East 50th Street in Midtown for $12 million. The LLC, 300 East 50th Street Owner, is registered to MaryAnne Gilmartin’s MAG Partners. The sellers were Bradley Wilson and Anne Evans via the LLC Wilson Evans 50th.