Senate flip: 5 real estate takeaways

Senate flip: 5 real estate takeaways

Trending

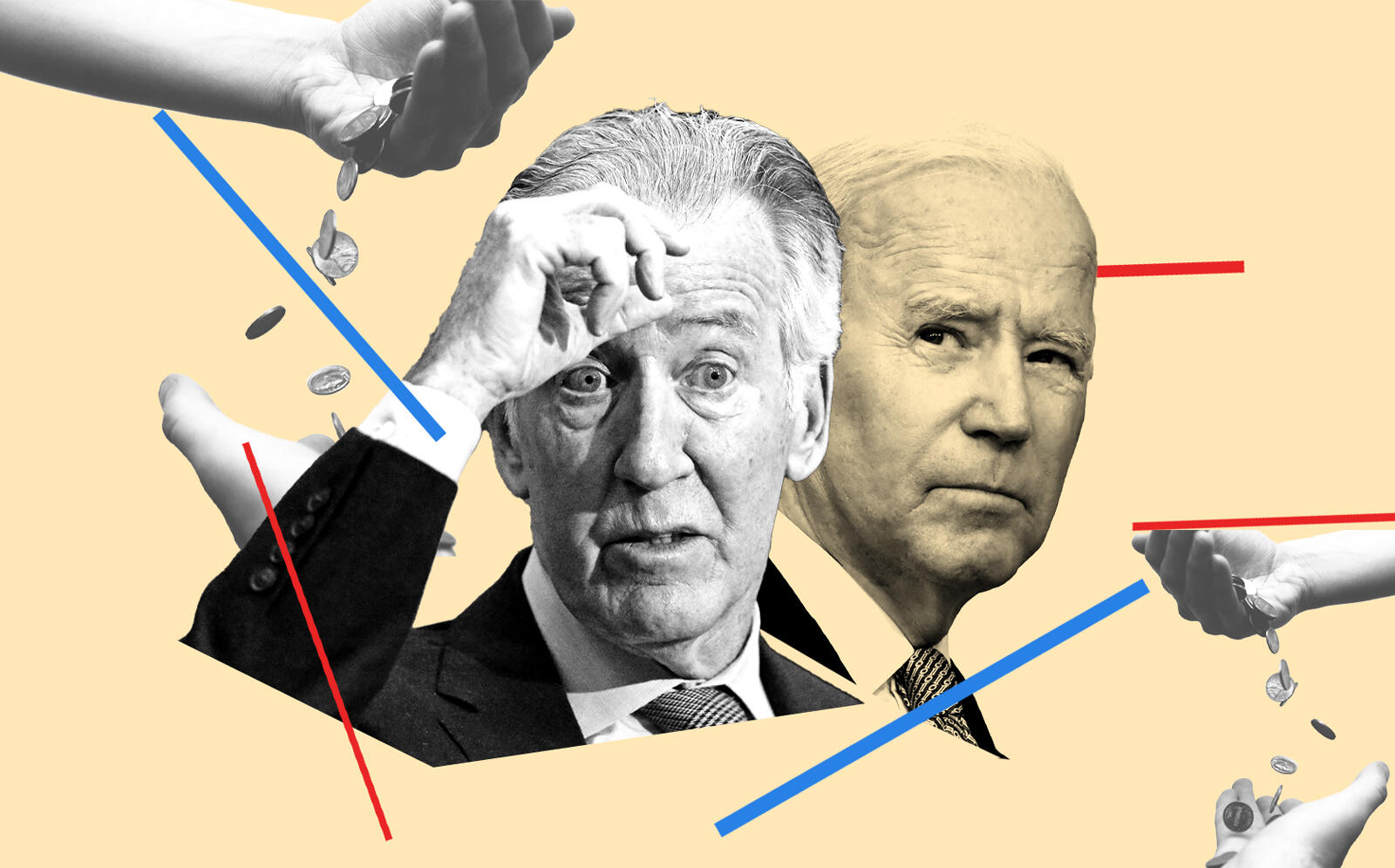

House Democrats consider curtailing Biden’s inheritance tax plan

Ways and Means Chair mulls alternatives to ending “step-up in basis” tax provision

The Biden administration proposed dramatically expanding the inheritance tax on wealthy Americans. House Democrats are pumping the brakes.

Democratic lawmakers are discussing a range of alternatives that would weaken Biden’s ambitious plans for taxing estates’ capital gains, Bloomberg reported Wednesday.

In an effort to finance social programs as part of the president’s American Families Plan, the Biden administration has proposed ending “step-up in basis,” a provision which allows heirs to use the market value of assets at the time of inheritance — instead of their historical purchase price — as the cost basis for capital gains taxes.

Put another way, the stepped-up basis wipes out past taxable gains on inherited property, letting heirs start from scratch. Biden wants past gains taxed upon death, which in many cases would force the sale of inherited properties.

But on a Tuesday call with progressive groups and tax policy experts, staffers for House Ways and Means Chair Richard Neal suggested instead allowing beneficiaries to defer tax payments as long as they hold on to the asset, according to Bloomberg.

The House Democrats’ proposal would disincentivize beneficiaries of larger estates from selling, thus reducing the tax revenue underpinning Biden’s $1.8 trillion American Families Plan.

Read more

Senate flip: 5 real estate takeaways

Senate flip: 5 real estate takeaways

Biden’s tax plan would “pull the rug out” from under the real estate industry: insiders

Biden’s tax plan would “pull the rug out” from under the real estate industry: insiders

The nonpartisan Urban-Brookings Tax Policy Center estimates that Biden’s current plan for increasing capital gains taxes on the wealthy would generate $370 billion in federal revenue over 10 years. The plan is also intended to address inequality issues that arise when wealth is passed from generation to generation without any capital gains tax.

New Jersey Democrat Bill Pascrell, a member of the House Ways and Means Committee, calls the stepped-up basis a loophole that fuels wealth inequality. He has introduced a bill to make the inheritance tax bill due at the benefactor’s time of death.

A clear path won’t be revealed until a Treasury Department report detailing Biden’s tax plans is released in the coming weeks, Neal told Bloomberg.

[Bloomberg] — Cordilia James