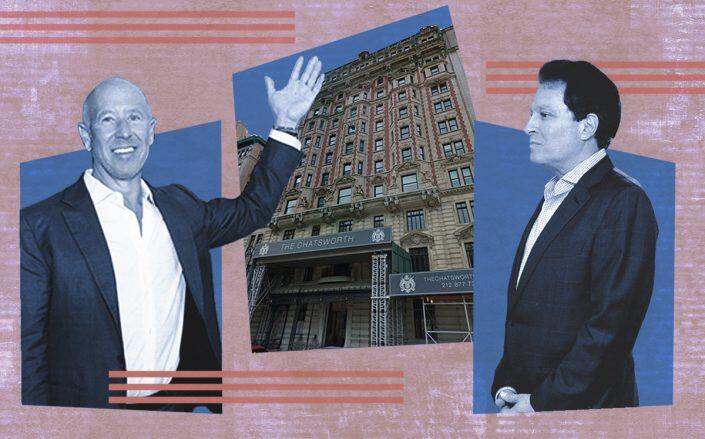

Starwood Capital CEO Barry Sternlicht and HFZ Capital chairman Ziel Feldman with the Chatsworth at 344 West 72nd Street and (Getty, Google Maps)

HFZ Capital’s portfolio of high-end New York City apartments is slowly eroding.

Ziel Feldman’s development firm has transferred 21 co-ops at the Chatsworth, its Upper West Side co-op conversion, to its lender, an affiliate of Starwood Capital. The deal was first reported by PincusCo and hit city records in early May.

Starwood did not return a request for comment.

The sale comes after a Starwood entity sued HFZ for $157 million in October. The lender alleges that HFZ, Feldman and his wife, Helene, defaulted on the senior and mezzanine loans, an unsecured loan and an inventory loan for the century-old building at 344 West 72nd Street.

Read more

The suit alleges there was an August forbearance agreement between HFZ and Starwood, in which the developer agreed to make payments totaling $9.1 million between Aug. 17 and Oct. 28. Starwood alleges HFZ missed those scheduled payments. The suit is still pending, according to court records.

In an answer to the amended complaint, HFZ’s lawyers denied Starwood’s allegations. Neither Ziel nor Helene Feldman returned requests for comment for this story.

HFZ bought the Chatsworth in 2013 for $150 million and quickly sought to convert the 147-unit Beaux-Arts rental building into co-ops. In 2017, HFZ sold 46 of the building’s rent-stabilized units to an entity linked to the Safra family for $38 million.

The once-prolific HFZ has turned over a number of its properties in recent months. Earlier this year, Los Angeles-based CIM Group, one of HFZ’s lenders, last month foreclosed on the junior mezzanine positions tied to four properties: 88 and 90 Lexington Avenue; The Astor at 235 West 75th Street; and Fifty Third and Eighth at 301 West 53rd Street.

In December, Monroe Capital, one of the firm’s lenders, foreclosed on HFZ’s stake in a national industrial portfolio. A month later, Westbrook, its partner on the Belnord condo conversion in Manhattan, told The Real Deal that the developer’s “only remaining connection to the project is that it holds a minority non-controlling residual economic interest.”