A Bronx industrial deal paid off for its investors.

A joint venture between Goldman Sachs Asset Management and Blumenfeld Development Group sold a 145,144-square-foot logistics facility at 1080 Leggett Avenue in Hunts Point to CenterPoint Properties for $116.5 million. That’s three times more than the $38.5 million that the investors paid two years ago, Commercial Observer reported.

“The location of 1080 Leggett Avenue in the southwest corner of Hunts Point is logistically strategic, and the asset is Class A by boroughs’ standards,” CenterPoint’s Investment Officer Mac Lee said in a statement to the outlet. “1080 Leggett’s last-mile distribution functionality and premiere proximity to Manhattan make it irreplaceable.”

Read more

CenterPoint is not a newcomer in New York City’s industrial scene. In January 2020, the Illinois-based industrial real estate firm shelled out $134 million to purchase almost 1 million square feet of warehouse space in Brooklyn.

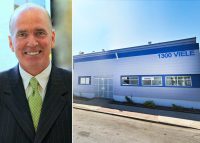

Like Brooklyn, the industrial market in Hunts Point has been heating up in the past few years. In 2019, Amazon leased a distribution center at 1300 Viele Avenue.

The owner of the Amazon-leased property at that time, MRP Realty and AEW Capital Management, managed to sell the facility for $70 million, or about three times more than what they paid 16 months earlier.

A JLL capital markets team led by Andrew Scandalios and Rob Kossar represented Goldman and BDG in the deal. The brokers told the publication that the building is fully leased to a “Fortune 500 company” through March 2030.

[CO] — Akiko Matsuda