A real estate investment firm is making a big bet on Soho.

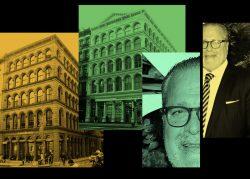

Northwood Investors has agreed to pay $325 million for a pair of mixed-use buildings in the heart of the neighborhood, the Wall Street Journal reported. The two buildings at 520 and 524 Broadway have a combined 180,000 square feet of office space and 60,000 square feet of retail space. The properties are 90 percent leased, with tenants that include Keith McNally’s Balthazar restaurant, the clothing store Aritzia and WeWork.

Northwood’s Shiva Viswanathan told the publication that the firm’s executives “are big believers in New York over the long term” and have recently been “actively looking for new investments.” He declined to comment on the details of the deal.

Read more

The pair of buildings have been owned by the Propp family since 1987, according to public records.

The portfolio attracted buyers’ attention because of their location “on the 50-yard line in SoHo,” said Cushman & Wakefield’s Doug Harmon, who, along with Kevin Donner, led a team to market the buildings.

The deal is an encouraging sign for the city’s commercial real estate market — especially considering that Soho was struggling even before the pandemic. On Prince Street, just a block from the portfolio, asking rents fell from $719 to $423 per square foot year-over-year in the fourth quarter of 2020.

Harmon told the outlet that the pair of buildings could have sold for more than $400 million about five years ago when the retail market was still booming.

[WSJ] — Akiko Matsuda