What distress? Dry powder piles up with few discounts in sight

What distress? Dry powder piles up with few discounts in sight

Trending

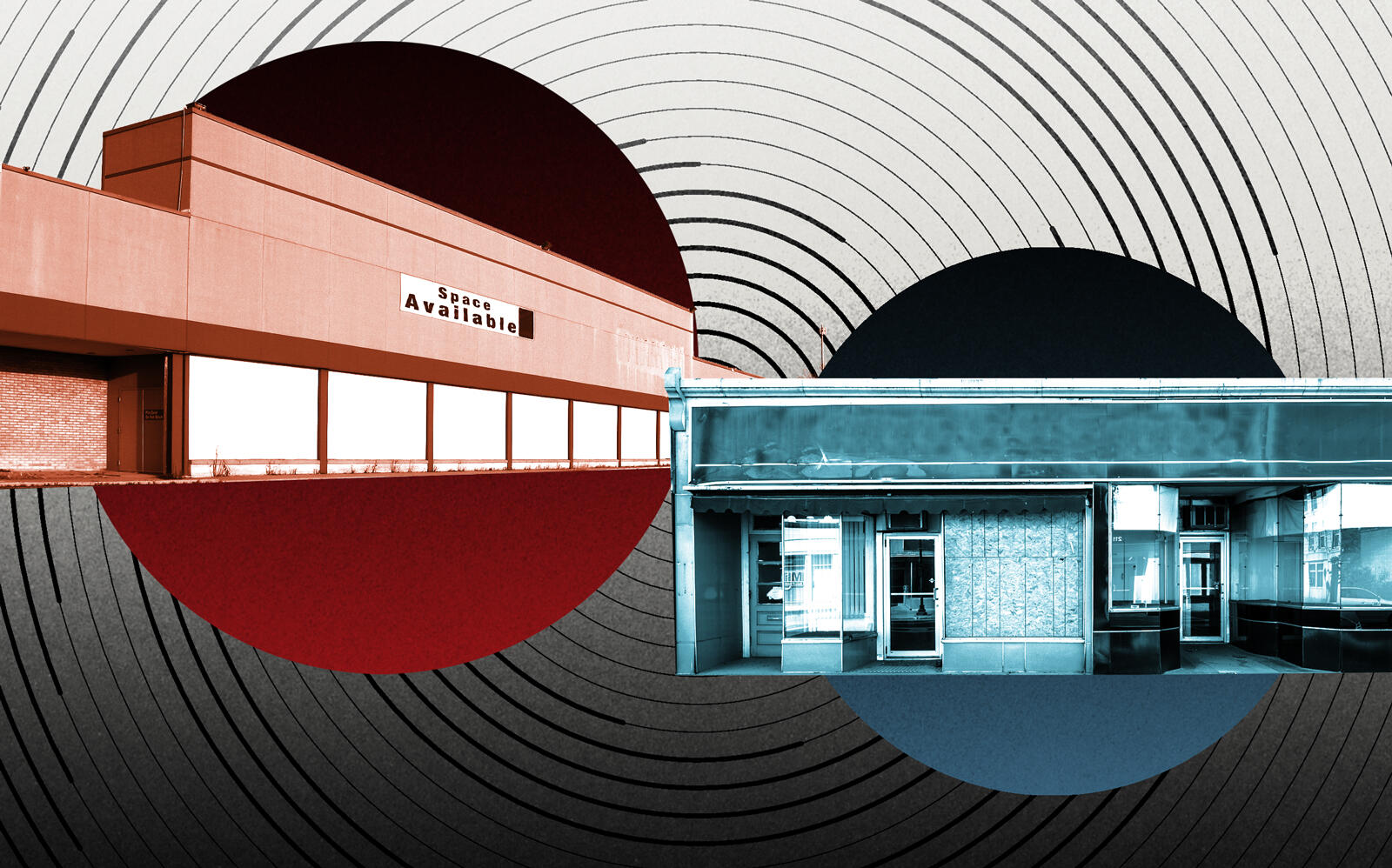

Distressed investors tap throwback strategy, target CMBS

Firms are digging through CRE bonds to seize, fix and flip troubled properties

Distressed real estate investors, short on troubled properties, have turned to a crisis-era favorite to suss out potential deals: commercial real estate bonds.

Hedge fund Axonic Capital and startup Metamorphosis Hotel Capital Partners are scrounging through commercial mortgage-backed securities for opportunities to seize, fix and flip troubled properties for profit, Bloomberg reported, citing sources with knowledge of the matter.

Read more

What distress? Dry powder piles up with few discounts in sight

What distress? Dry powder piles up with few discounts in sight

What appraisal reductions mean for future losses on CMBS loans

What appraisal reductions mean for future losses on CMBS loans

Firms adapted a similar strategy during the global financial crisis. Now, investors are seeking mortgages that may have been bundled into bonds on the hunch that those debts are more likely to be sold in the event of a missed payment.

Earlier in the pandemic, money-management firms made billions promising investors big returns on the swath of commercial real estate carnage — hotels, offices and malls that couldn’t pay their mortgages. But lenders offered extensions, betting that a return to normalcy would provide property owners with the business to make payments, the publication reported.

Axonic and Metamorphosis, which declined to comment to the publication, are betting there are still some owners that can’t.

“This is an interesting strategy that’s proven successful in other asset classes,” Paul Norris, head of securitized-credit investing at asset management firm Conning & Co., told Bloomberg. “We expect to see more hedge funds do this.” Norris said he is not pursuing the strategy himself.