UPDATED, June 10, 8:37 p.m.: As HFZ Capital began to run into trouble with its twisting XI condo project in Chelsea, an investor alleges the company fraudulently diverted funds from another deal to keep it afloat.

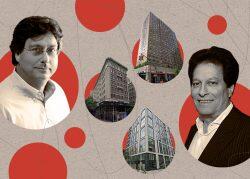

Arel Capital’s Richard G. Leibovitch

New York-based Arel Capital is suing HFZ Capital affiliates over a $7.3 million investment it made in four former HFZ Capital buildings in 2014. HFZ Capital was seeking to convert four pre-war rental properties into condos: at 88 Lexington Avenue; 90 Lexington; 301 West 53rd Street; and The Astor at 235 West 75th Street.

Arel alleges that it had a minority equity stake in the portfolio and was supposed to get paid back after HFZ secured a $600 million refinancing in 2016. The company says that instead of receiving any of the funds from the refinancing, the money was instead diverted to pay down loans at the XI, which was experiencing financial issues.

Read more

Arel alleges that HFZ, along with its top executives, Ziel Feldman and Nir Meir, diverted the money at the behest of JPMorgan Chase, which was a lender on both the condo conversion portfolio and the XI. (JPMorgan was a senior lender for the refinancing and a mezzanine lender for the XI.)

The lawsuit, filed in New York Supreme Court this week, also alleges “the defendants concealed the diversion of funds for years, deliberately refusing to provide the plaintiff with a complete and accurate accounting” of the 2016 refinancing.

HFZ Capital and Ziel Feldman did not return a request to comment. JPMorgan declined to comment.

Nir Meir’s attorney says that all the claims are frivolous and he said the developers put in $100 million of their own money to try to save the condo portfolio.

“The claims are entirely without merit,” said Larry Hutcher of Davidoff Hutcher & Citron.

Arel also alleges that HFZ likely violated New York’s Martin Act by pre-offering two apartment units in the Astor to Arel. An attorney for Arel Capital did not return a request for comment.

In January, CIM Group foreclosed on the four Manhattan condo conversion projects and took control of the properties. CIM Group is suing HFZ and Feldman for guarantees made on junior mezzanine loans tied to the four properties. CIM Group initially provided those loans in 2018.

The development firm, led by Feldman, initially paid Westbrook Partners $610 million for the four properties in 2013, teaming up with Fortress Investment Group on the buy.

Construction on the XI has also been stalled. The unfinished building, designed by architect Bjarke Ingles, contains 236 units spread between two twisting towers with a projected sellout of $2 billion. The Real Deal previously reported that Suffolk Construction and Zeckendorf Development are planning to take over the project.

HFZ was once among New York’s most prolific condo developers, but it is now engulfed in lawsuits, foreclosures and infighting. Feldman and Meir, who left the company in December, have sold off some of their personal residences. Recently, Meir sold a mansion in Bridgehampton to Patriots owner Robert Kraft for $43 million.

Correction: A previous version of this story misstated Meir’s attorney’s comment regarding the developer’s investment.