It’s a dicey time to be in the midst of a billion-dollar office project.

Developers of the Terminal Warehouse in West Chelsea find themselves in an unprecedented market, with the availability rate in Manhattan at a record high and rents at a four-year low.

But L&L Holding Company and Columbia Property Trust are plowing ahead with the redevelopment, aiming to bring more than 1 million square feet of office space online in a few years. They even see a silver lining.

“As difficult as the time period was in general, I think for this project, we probably benefited from the stage we were in at the time the pandemic hit,” said Paul Teti, Columbia’s executive vice president of real estate operations. That is, it was early enough in the design process to reflect the needs of tenants in the post-Covid environment.

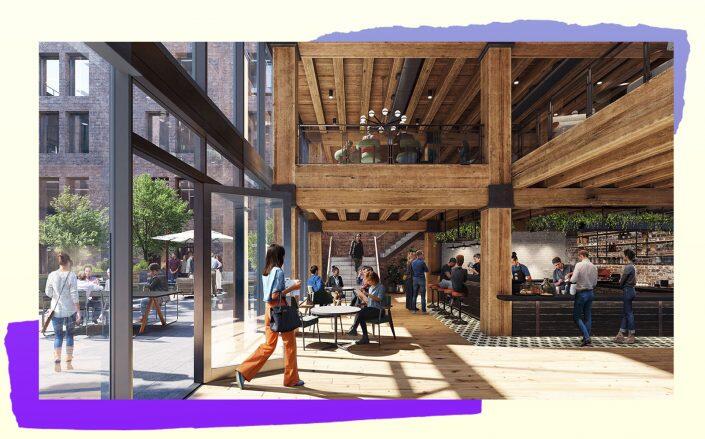

The $1.8 billion redevelopment aims to transform the late-19th-century, 1.2-million-square-foot landmark warehouse into offices, retail space, food and beverage areas, and other indoor and outdoor amenities.

The developers are not hiding that it isn’t a prototypical Manhattan trophy project like the 1,401-foot One Vanderbilt, which is asking $322 per square foot on the top floor. Instead, they refer to Terminal Warehouse as a “groundscraper.”

With the availability rate up to 17.1 percent, Manhattan offices’ average asking rent in July was just $72.72, the lowest since 2017, according to Colliers International.

But L&L and Columbia cater to office tenants who are willing to spend on high-end space to attract and retain top talent. They don’t see much of Manhattan’s empty square footage as competition for the Terminal Warehouse. The landlords expect the post-pandemic environment to benefit the full-block structure at 261 11th Avenue because more tenants will seek high-quality space, Teti said.

“Perhaps there has never been a time when landlords and employers have been so aligned in terms of creating the best and healthiest environments to bring employees back, particularly those that have not been back in the office environment,” Teti said.

Flight to quality

Prospective office tenants’ shift toward updated, higher-quality properties has been on display in recent weeks as they flock to tour buildings “that have gone through a significant renovation or new construction,” said David Falk, Newmark’s New York tri-state region president. He added that office properties that are not newly built or renovated “will lease the slowest” in this market.

The West Chelsea project has been in the making for three years; L&L and Normandy Real Estate Partners purchased the building for $880 million in 2018. Columbia entered the picture when it acquired Normandy in 2019. The developers recently secured a $1.25 billion construction loan, among the largest real estate loans made during the pandemic.

Sarah Bouzarouata (LinkedIn)

A flight to quality among office tenants was trending even before the pandemic, said Sarah Bouzarouata, manager of New York office research at JLL.

About 37 percent of Class A office leases signed in 2019 were in new construction, up from 13 percent four years prior, according to Bouzarouata. “The pandemic has further accelerated the shift toward healthier, better quality space,” she said.

“We saw a lot of occupiers looking to seize opportunities to upgrade their offices” as rents fell in recent months, she said.

Properties that have benefitted from the flight-to-quality trend include One Vanderbilt, SL Green Realty’s new Midtown spire. The 67-story, 1.7-million-square-foot tower is 90 percent leased — months ahead of the company’s projection — and more deals are being negotiated, according to the landlord.

Read more

The trend is also apparent in subleasing: About 90 percent of subleases signed during the pandemic were in trophy and Class A properties, “driven by tenants taking advantage of opportunities for discounted, high-quality, furnished space,” Bouzarouata said.

But the market for new and renovated Manhattan office space is expected to be a lot more competitive in the coming years because many projects are in the pipeline, said Franklin Wallach, Colliers’ senior managing director for New York research.

“Over the next three years — 2022, 2023 and 2024 — there is nearly 25 million square feet of new office construction or major renovations scheduled to come online in the Manhattan office market,” Wallach said. “That is the largest amount in a three-year period since the 1980s.”

While that will strain the recovery of the market, it will also energize it by attracting innovative companies, said Wallach, who noted that almost half of Manhattan’s 540 million square feet of office inventory is pre-war space. Manhattan needs newer product to compete against other global cities, he said.

Pandemic-driven updates

The Terminal Warehouse project was approved by the Landmarks Preservation Commission in January 2020, and its design process was well underway when the pandemic threw New York City into lockdown.

Bells and whistles such as LEED platinum status and Well and WiredScore certifications were in the initial plans but the health crisis led the developers to push the envelope. They upgraded the air filtration system, made elevators touchless and improved the staircase environment, said Andrew Staniforth, L&L’s principal & senior vice president.

Rendering via Gensler/TMRW

In addition, the bike concierge program has been expanded to accommodate more than 500 bicycles in the cellar, Staniforth said. The property, between 11th and 12th avenues and West 27th and 28th streets, is steps from the Hudson River Greenway, a 13-mile waterfront path connecting uptown and Lower Manhattan. Post-pandemic commuters might bike to work more often, he said.

The project moved along throughout the pandemic, gearing toward the structural demolition work, which started a few days after the $1.25 billion loan closed in late July.

The loan consisted of a $975 million senior mortgage with an interest rate of Libor plus 5 percent, and a $275 million mezzanine loan at Libor plus 10.75 percent, a source told The Real Deal. The source characterized the rates as competitive, given the increased risk from the pandemic, which has made work-from-home a standard practice. The landlords declined to comment on the loan package.

The redevelopment will transform the building’s storage space into offices and a courtyard. The plans also include replacing the arched windows and adding a six-story glassy structure atop the existing seven-story section on the west side of the building.

It is expected to start welcoming tenants sometime in 2023.

Rich Bockmann contributed to this article.