Zillow didn’t set any profit records in the second quarter, but it did deliver all-time-high revenues in results consistent with a strong housing market.

The Seattle-based listing giant reported $9.6 million in net income for the quarter, down from $52 million in the first quarter, but far better than the $84 million net loss during the same period last year, when the pandemic brought the housing market to a near standstill.

A year later, as home prices continue to rise, Zillow brought in a record $1.3 billion in revenue, up 70 percent year-over-year and roughly 8 percent over the first quarter.

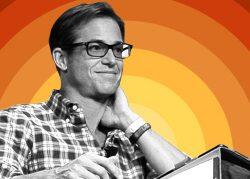

On an earnings call Thursday, Zillow founder and CEO Rich Barton said he believes the housing market has “strong, durable support” driven by three main factors: millennials aging into homebuying years, low interest rates and the “great reshuffling,” Barton’s term for the rise of remote work. He said that he expects these trends to keep the housing market strong, regardless of a “super rapid sales cycle,” and called the shift from offline to online purchasing “the big lever.”

Barton elaborated at length about the rise of remote work during the call.

“We at Zillow lean in hard and early on the ‘Cloud HQ’ idea as the future of work,” he said, after announcing himself as dialing in from Zillow’s “Cloud HQ.”

“Moving to the big city is no longer a requirement for many job seekers and that shift will inevitably disperse talent and economic opportunity,” he continued. “This is one of the factors we see driving the housing market for some time.”

To emphasize the point, Barton said that Zillow has received 152,000 job applications so far this year. He believes that’s in part due to the company’s current location-flexible policy.

The majority of the company’s revenue, $777 million, came from its homes segment, which includes its iBuyer program Zillow Offers as well as title and closing services. Of that, Zillow Offers brought in $772 million, but the segment ended the quarter with a net loss of $59 million.

Barton said the iBuyer program saw a record number of homes purchased, 3,805, and sold, 2,086, during the quarter.

Agent advertising drove the company’s profits. Revenue from its Premier Agent advertising program was $384.7 million, up 82 percent from a year earlier. Zillow’s internet, media, and technology segment — which includes Premier Agent — generated $133 million in profits during the quarter.

Zillow’s mortgage business was responsible for $56.7 million in revenue, but reported a $17.6 million net loss.

Operating expenses totalled $476.6 million, with sales and marketing accounting for the biggest portion of spending in the quarter at $229 million.

Read more