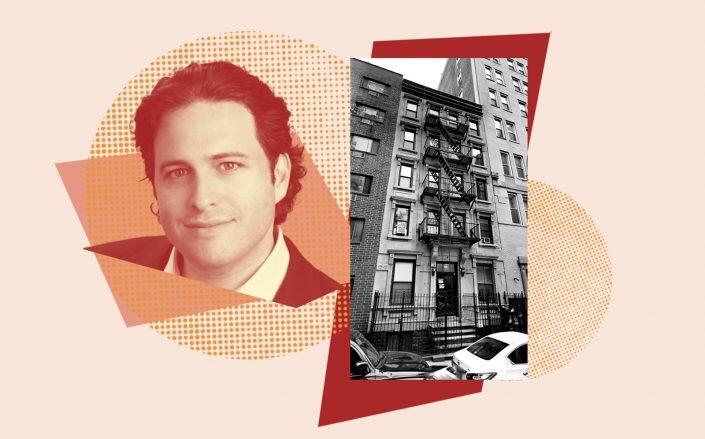

Maverick Real Estate Partners principal David Aviram and 416 West 25th Street (Google Maps and LinkedIn)

They were certainly preying for a different outcome.

On Monday, a judge ruled yet again against Maverick Real Estate Partners in its quest to foreclose on a borrower. For three years, the distressed debt firm led by David Aviram has been battling Andreas Steiner, the owner of a five-story rental building at 416 West 25th Street, alleging various breaches of contract. But the latest ruling against the firm sides overwhelmingly with Steiner, leaving Maverick with few options.

The saga started in 2014, when Steiner scored a $3.6 million mortgage for the property from New Jersey-based Peapack-Gladstone Bank. He took out a subordinate loan in March 2017 without telling the bank, against the terms of his initial mortgage, which stipulated that any secondary loans required Peapack’s written pre-approval, filings show. The bank sent Steiner a notice of default the following June. However, Peapack didn’t provide Steiner 30 days to cure the breach as the lease prescribed. Rather than chase the case down a rabbit hole, Peapack sold the debt to Maverick that August.

Within the month, Maverick moved to foreclose on the property for the same breach of contract. Yet, the firm also failed to provide 30 days’ notice, and in May 2019, a judge dismissed the action.

During the suit, Steiner didn’t pay the mortgage. As soon as the judge threw out the foreclosure action, Steiner sent Maverick nine checks for the arrears, each worth $24,705. He also requested a payoff statement detailing his remaining debts, stating that he intended to pay off the remainder of the mortgage. But Maverick wasn’t game for that.

Read more

A week after Steiner sent the checks, Maverick sent him the requested statement, but it included unexpected charges. In addition to back rent, Maverick claimed Steiner owed them interest for the nine months of missed payments, calculated at a 24 percent default interest rate. They also demanded compensation for legal fees stemming from their failed foreclosure. To top it off, just two weeks after a judge ruled against its first foreclosure attempt, Maverick sent Steiner another default notice.

Having learned its lesson, Maverick included a 30-day cure period in their new notice, which still sought to boot Steiner over his subordinate mortgage from 2017. But in July 2019, the same judge dismissed Maverick’s claims again. Now it was Steiner’s turn to go on the offensive.

That August, Steiner argued that Maverick’s decision to charge 24 percent interest was unfounded and that he didn’t owe the firm legal fees for a case it didn’t win. Now, after two years of litigation, the court has sided in favor of Steiner. The new order gives Maverick 20 days to provide a correct payoff letter that doesn’t impose default interest rates or call for reimbursement for legal fees on the foreclosure suits.

“This case is important because it highlights what too often is relegated to the shadows — notably the hyper-aggressive, and often improper, tactics of certain ‘loan to own’ lenders who exploit the legal system to force borrowers to capitulate to their wrongful demands or risk losing their properties in the process,” Steiner’s attorneys, Aaron Solomon and Terrence Oved, said in a statement. “It is truly a David versus Goliath scenario.”

Maverick, which didn’t respond to request for comment, has a long history of buying the debt of and then foreclosing on distressed properties. It’s currently trying to foreclose on a $30 million condo at 432 Park Avenue, whose owner has stopped paying the mortgage and whose original lender has reportedly been detained in China.