State Street Corp. is planning to move out of its two Midtown office buildings.

The Wall Street firm, known for commissioning the “Fearless Girl” statue in the Financial District, plans to close its offices at 1040 Avenue of the Americas and the 10th floor of 1290 Avenue of the Americas, the company said in a statement.

State Street plans to sublease the space to other firms, according to the Wall Street Journal. The firm said it has adopted a hybrid work plan where workers have the option of working remotely or from its office spaces in Connecticut or New Jersey. It will also add a shared office space.

State Street’s departure likely adds to the anxiety of Midtown Manhattan landlords who have been eagerly waiting for employees to return to the office. Many companies initially projected September as a target date to return, but some firms have postponed their plans because of the Delta variant. Wells Fargo, BlackRock and Amazon all recently pushed back their return to work plans.

“We absolutely see the value for having physical space in the area that serves as a hub for employees and clients in the NYC area, but we also know this is a tremendous opportunity to reimagine and redesign the workplace in a very fit-for-purpose way that improves performance, productivity and our employees’ experience,” said State Street in a statement to TRD.

Read more

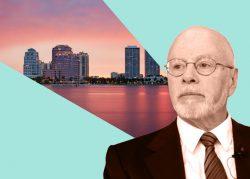

Some New York financial firms have also leased space outside of New York. Earlier this year, private equity firm Blackstone leased 41,000 square feet in Miami where 200 tech employees will work for the private equity giant. Paul Singer’s Elliott Management Corporation relocated its headquarters to Florida earlier this year.

Manhattan’s office availability rate was 17.1 percent in July, matching the record-high set in May. The average asking rent was $72.72 per square foot, down nearly 8 percent from a year ago and the lowest level since 2017.

Boston-based State Street is one of the world’s largest asset managers. The closures will impact about 500 employees at the firm’s custody bank and money-management businesses, according to the Journal.