HFZ Capital’s New York real estate portfolio is vanishing and now its woes are extending beyond the city.

The Manhattan-based developer and its investment partners are trying to sell the Fisher Building — a century-old Art Deco tower that has been described as “Detroit’s largest art object” — before its renovation is complete.

The group has also listed two surface lots and two parking garages for sale.

The Platform, a minority owner led by iconic Detroit real estate developer Peter Cummings, announced the sale in a release, which said the developer put in $30 million to revitalize the 30-story property from a state of disrepair.

Considered by some to be architect Albert Kahn’s masterpiece, the Fisher is a National Historic Landmark and features a 2,000-seat theater.

“The Platform and its partners have made substantial progress in turning around the building, but the ownership group mutually agreed that now is the right time to find the next steward who can finish the job, ” a Platform spokesperson said.

Read more

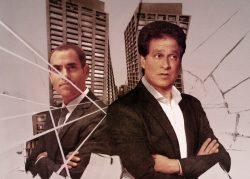

Ziel Feldman’s HFZ Capital partnered with Detroit-based REDICO, the Platform and Rheal Capital Management to buy the Fisher Building and the neighboring Albert Kahn building, two parking garages and two surface lots for $12.5 million in a 2015 auction.

In 2016, REDICO exited its stake in the project. HFZ Capital owns 65 percent of the building and the Platform and Rheal Capital Management remain minority owners. (In 2018, the partners sold the Albert Kahn building for $9.5 million.)

HFZ Capital’s Ziel Feldman said in a video interview with Bisnow in 2017 that he bought the Detroit properties after a professor told his son, a University of Michigan student, that the buildings were in distress and would be hitting the market. He added that HFZ was able to buy it for “a lot less than he anticipated” on auction.com.

“It really fits our brand where we want to be the best-in-kind in locations but primarily the architecture,” said Feldman. At the time, HFZ was actively buying up historic Manhattan rental properties, such as the Belnord on the Upper West Side, and turning them into luxury condos.

When HFZ and its partners stepped in, the Fisher was in need of serious repair. The ownership group started restoring the facade, whose 325,000 square feet of marble made it the world’s largest marble-clad commercial building, according to the Platform.

The owners also installed an HVAC system, air-conditioning the building’s Arcade for the first time.

A spokesperson for HFZ said of the listing, “We are proud of the success the partnership has had in repositioning the Fisher Building. The partnership has determined that now is an opportune time to realize our investment and all the value we have created.”

Over the past year, HFZ’s business has nearly collapsed. The company faces numerous lawsuits and liens over unpaid bills and has lost some buildings to foreclosure.

Recently, the firm sued its former managing partner Nir Meir. Its complaint called him a “sociopath” 17 times and alleged he siphoned money out of the company to pay for personal expenses, including cars and a $150,000-a-month Miami Beach rental. Meir’s attorney has denied these claims and said, Ziel is trying to “salvage his otherwise unsalvageable reputation.”

The company is now in danger of losing its most valuable building, a twisting condo project on the High Line known as the XI, to foreclosure. The company, Feldman and Meir are also the subject of a New York state attorney general complaint.