Bill Gates’ Cascade Investment is taking a swing in the hotel industry, paying more than $2 billion to take control of Four Seasons Hotels & Resorts.

Cascade is planning to buy 23.8 percent of a stake belonging to Saudi Arabian Prince Alwaleed bin Talal, spending $2.2 billion, according to Reuters. The purchase will give Cascade a 71.3 percent stake and operating control of Four Seasons.

Prince Alwaleed is hanging on to his remaining stake. The purchase values the hotel chain at about $10 billion on an enterprise basis.

Gates is taking a risk in a hotel market that has been struggling throughout the pandemic, despite showing some signs of life more recently. The market in New York City is in the midst of a depression as occupancy rates hover well below typical summer numbers. A CBRE study estimated that the market wouldn’t recover until 2025.

Yet Cascade has shown a willingness to spend big during the pandemic. Last October, Cascade formed a partnership with Singapore sovereign wealth fund GIC for stakes in Storage Mart, a deal valued at about $2.7 billion.

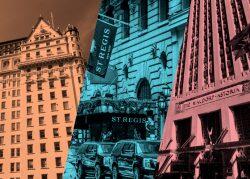

While specializing in hotels and resorts, Four Seasons has expanded to residential rentals as well. The company has more than 100 hotels and resorts around the world. The company doesn’t typically own its properties, instead operating them on behalf of developers.

Four Seasons was founded in 1960 by Isadore Sharp, who will be retaining a five percent stake in the company, according to a press release on the pending sale. Four Seasons went public in 1997, when Cascade first invested in the business. The sale is expected to close in January 2022.

Read more

[Reuters] — Holden Walter-Warner