The numbers were awful.

Almost a quarter of New Yorkers were overweight, and eight in every hundred were diabetic. In just two years, city residents put on 10 million pounds.

The unsettling figures, unearthed in a 2008 study by the Department of City Planning, fingered real estate as a culprit: Too many New Yorkers lacked a supermarket.

Around 3 million New Yorkers fell into “high-need neighborhoods,” the city’s neologism for food deserts and their cousins, food swamps (where junk food overwhelms the good stuff). The shortage hit not only consumers’ waistlines but their wallets, as they had to spend more time and more money to get their food.

The following year, the city responded with the Food Retail Expansion to Support Health Program. FRESH offered zoning and tax incentives to encourage developers to build more supermarkets in high-need neighborhoods.

The de Blasio administration is now pushing to extend the zoning incentives to even more neighborhoods, but the program’s results have been mixed, at best. Few supermarkets have opened under the program, and most applications have been in Harlem and Bedford-Stuyvesant, leaving out vast areas of the city.

Twelve years in, just 27 buildings have qualified for FRESH zoning benefits and only eight are up and running. Of the 28 that received tax incentives, 22 are completed.

In a city with 8.8 million stomachs, even supporters of the program believe it could be doing more.

“The number of supermarkets that have opened using FRESH incentives is actually modest in comparison to the turnover of the retail food sector. Supermarkets open and close all the time in New York City,” said Nevin Cohen, research director of the CUNY Urban Food Policy Institute.

Moreover, some of the projects that got the incentives might have happened anyway.

The city offers up to 20,000 extra residential square feet beyond a building’s zoned limit — one square foot of apartment for every square foot of supermarket. The City Planning Commission can allow an extra 15 feet of height to make room for the bonus space.

An array of tax breaks sweeten the deal. For 25 years, property taxes are frozen at pre-improvement amounts and land taxes are fully abated (both benefits begin phasing out after 21 years). Developers also can skip paying city and state sales taxes on construction and renovation materials.

One supermarket can make a huge difference for a neighborhood, said Cohen. A single store can decrease obesity rates, and access to fresh fruit and vegetables is crucial. But incentivizing grocery development has turned out to be a tricky business. Gentrification, rather than the city’s initiative, appears to be driving developers’ decisions.

A cornucopia in East Harlem

Eran Polack considered building in cities from Atlanta to Boston before choosing East Harlem. After buying and falling in love with a smaller building between First and Pleasant avenues on East 116th Street, he doubled down on the neighborhood. In 2014, his firm, HAP Investment Developers, purchased the lot at 2211 Third Avenue for $13 million, according to public records.

“East Harlem was very cheap then and still very close to everywhere,” said Polack. His firm now owns six buildings in East Harlem. The 108-unit, mixed-use building at 2211 Third Ave is by far the largest.

“I’m seeing a lot of young professionals that want to live in Manhattan and not spend all of their salary on rent,” said Polack. “They’re coming [to East Harlem] because the price makes sense — the young generation is much smarter, more calculated, and willing to explore new places.”

Under a glass awning, a sign markets the building’s luxury apartments. Under the 421a tax abatement, 20 percent of its units are affordable. And in its ground-floor retail space lies a Foodtown. In a high-obesity neighborhood light on supermarkets, it is a poster child for the FRESH program.

The grocery’s automatic doors slide open to a rainbow of fresh fruits and vegetables. There are seven varieties of peppers, eight types of apples and avocados the size of a baby’s head.

“Qué Ha Pasao” plays on the store’s intercom, a fitting addition to the standard grocery-pop blare for a store in Manhattan’s second-most Latino neighborhood. There’s a deli counter, fish stand and bread baked in Queens. It stocks fresh meats from pork feet to chicken thighs, ribeyes to gizzards.

The Foodtown meets all of the FRESH program’s size and fresh-food requirements, and its 12,000 square feet are clean and well-stocked. At first glance, 2211 Third Ave looks like smart public policy in action. That is, until you turn around.

Directly opposite Foodtown, at 2212 Third Avenue, sits City Fresh Market. Its own glass doors slide open to a near-identical rainbow of produce. It stocks the same gargantuan avocados and poblano peppers. It was there for years before HAP even broke ground across the street.

Of all the corners in East Harlem that could use healthful food offerings, the city subsidized a new supermarket right next to one that already existed.

“That’s obviously not what the program was intended to do,” said Cohen.

The Department of City Planning asks developers to perform “due diligence” before applying for a FRESH supermarket. Somehow, Foodtown slipped through the cracks.

HAP was awarded an additional 12,000 square feet of residential space over the zoned maximum, enough for about 16 units, according to Polack. This year, the average studio in the building has rented for $2,200 a month, so the FRESH units are pulling in roughly half a million dollars per year.

The Brooklyn cluster

In 1989, Spike Lee released “Do the Right Thing,” depicting the racial tensions stewing in Bed-Stuy between locals and food stores run by outsiders. Two decades later, as the traditionally Black neighborhood gentrified, so did the places residents could get their food.

In 2010, new arrivals in the neighborhood earned roughly the same amount as those who had lived there long-term. By 2015, the median longtime resident took home just 55 percent of what a newcomer did, according to a 2017 report by the state comptroller.

Bed-Stuy’s housing market has followed suit. In the last decade, the neighborhood’s median home sale price shot up 145 percent, according to data compiled by real estate appraiser Miller Samuel. “Compared to the borough [as a whole], Bed-Stuy saw nearly double the price growth rate over the decade,” said the firm’s CEO, Jonathan Miller.

Read more

Grocery and beverage stores make up more than half of the neighborhood’s 500 retail stores, according to the comptroller’s report. Not all of them offer fresh fruit and vegetables, but the neighborhood’s food options have clearly improved thanks to its strong housing market.

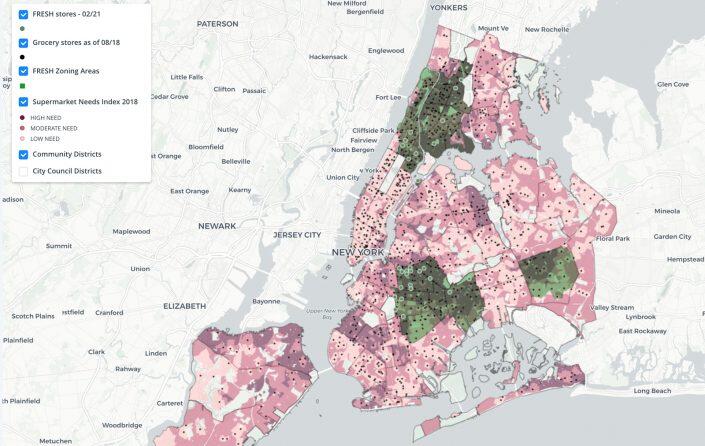

Map of NYC with Supermarket Need Index

Bed-Stuy is also the FRESH program’s most popular neighborhood. While some FRESH zones haven’t gained a single store, 10 have either opened or been approved in Bed-Stuy, according to a Department of City Planning map.

It’s no surprise that developers build more in desirable pockets of the city. And zoning incentives are worth less in weak housing markets, so even with FRESH allowing more market-rate units, a project might not pencil out.

These simple market forces have made it challenging to spur supermarkets in areas that need them most. Instead, the stores have been concentrated where they might well have happened without incentives. Gentrifying neighborhoods like Bed-Stuy that still score high on the city’s Supermarket Need Index pull the lion’s share of FRESH stores.

“The challenge with zoning is that the conditions of the market will change but the zoning will last for decades,” said Jennifer Gravel, City Planning’s director of housing and economic development.

Fixing FRESH

Now, the agency is looking to expand the program while plugging some of its holes. It is clear-eyed about the problem. “Approximately half of the certified projects are concentrated in Brooklyn, and applications have been concentrating in specific areas with strong housing markets, such as Bedford-Stuyvesant and Harlem,” it wrote in announcing the public meeting.

As it stands, developments in 19 community districts can apply for FRESH zoning benefits. At a Sept. 22 hearing, city planners will make the case for expanding and reforming FRESH. They want to spread the zoning incentives to 11 more districts, some of which already offer the tax incentives.

In order to discourage clustering, the proposal would cap the residential square footage bonus that gave Polack so many extra apartments. The plan would limit the additional floor area to 40,000 square feet within a half mile of any proposed FRESH store, with earlier applications getting priority.

The proposal is in the midst of the city’s text amendment review process. After this month’s hearing, the City Planning Commission will vote on it; approval is expected. It would then move to the City Council for a hearing and vote to determine the outcome.

“Like anything new, you realize the first time you did it, there’s some things you can improve upon,” said Gravel.