Vornado to sell five Manhattan retail properties, takes loss of $7M

Vornado to sell five Manhattan retail properties, takes loss of $7M

Trending

Reuben Brothers to buy Vornado buildings on Madison Ave

Vornado recently announced $185 million sale of five properties

Vornado Realty Trust’s recent $185 million sale is coming into focus as the buyer was revealed on three of the five unloaded properties.

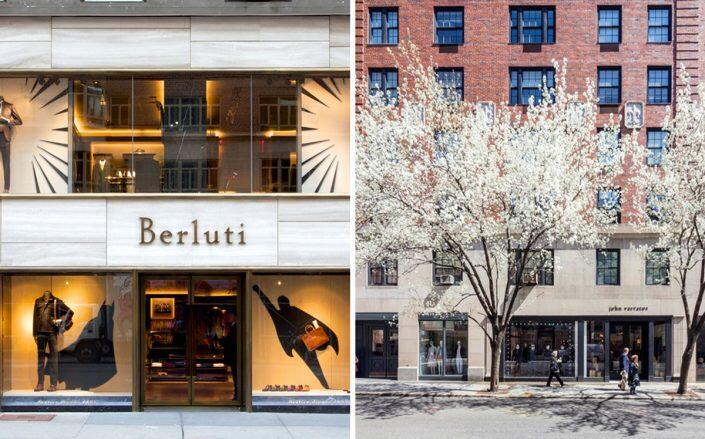

Reuben Brothers have swooped in to buy 677 Madison Avenue, 759 Madison Avenue and 828 Madison Avenue, according to the Commercial Observer. The price has not been reported, but Vornado is expected to take a $7 million hit on its sale of the five assets.

Vornado also sold a loft building at 478 Broadway and the retail part of 155 Spring Street, both in Soho. It’s not clear yet who acquired them.

When announcing the sale, Vornado said the properties had a “negative income.” The real estate investment trust, led by Steve Roth, said occupancy at the properties stood at just 30 percent.

Read more

Vornado to sell five Manhattan retail properties, takes loss of $7M

Vornado to sell five Manhattan retail properties, takes loss of $7M

Brookfield taking big loss on Fifth Ave retail condo

Brookfield taking big loss on Fifth Ave retail condo

Reuben Brothers — the investment firm of British siblings David and Simon Reuben — is betting big on Madison Avenue retail, which has struggled during the pandemic. The shopping corridor, which stretches from East 57th to East 72nd streets, has typically commanded some of the highest retail rents in New York City.

677 Madison Avenue and 759 Madison Avenue (Vornado)

But the area has fallen on challenging times, with foot traffic at 71 percent of its 2019 level, according to an estimate from Orbital Insight. The availability rate along the corridor is 39 percent, the highest in Manhattan — perhaps an indication that some landlords are looking for the high rents of yesteryear.

The Madison Avenue portfolio is a consolation prize of sorts for Reuben Brothers. The firm was in the running to acquire 530 Fifth Avenue from Brookfield Property Partners, which ultimately sold the retail building to a joint venture of Aurora Capital Associates and Edmond Safra for $192 million; Brookfield took an approximately $100 million loss on the sale.

The self-made billionaire brothers began hunting for New York deals last year during the pandemic. They paid $170 million for a Fifth Avenue retail condo and have lent tens of millions of dollars to others.

[CO] — Holden Walter-Warner