ViacomCBS sells Black Rock building to Harbor Group for $760M

ViacomCBS sells Black Rock building to Harbor Group for $760M

Trending

Flight to quality in office real estate leaves trophy buildings the only winners

As office markets emerge from pandemic shock, Class B and C properties will suffer the most, analysts say

Seventeen months into the pandemic, Black Rock — the famed Eero Saarinen-designed skyscraper whose hulking presence has loomed over Manhattan’s Sixth Avenue for nearly 60 years — finally found a buyer.

When the deal closes later this year, the 38-story office tower at 51 West 52nd Street will fetch $760 million, or about $874 per foot, nearly 25 percent less than the $1 billion that owner ViacomCBS sought for its longtime home before the pandemic ravaged the city’s office market.

Just how much Covid-driven uncertainty contributed to the haircut is unknown. None of the parties involved in the negotiations would comment. But sources said that the delayed sale, which came almost two years after ViacomCBS announced its intention to shed the property, shortened its existing lease terms to less than five years.

The fact that the seller is going to lease back about a third of the building’s 870,000 square feet on a short-term basis — meaning the buyer will assume the responsibility of securing new tenants to occupy a large portion of the building in the near future — also likely had an impact.

“I thought it was a very good price that they got, especially in the current environment,” said Scott Rechler, CEO of RXR Realty, which was not involved in the deal. “It’s a classic building. It’s a great location. But it still needs to have a big investment made into it to bring it into the 21st century.”

In the early months of the pandemic, sales contracts for multi-tenant office buildings negotiated pre-Covid often had to be reworked, resulting in 5 to 13 percent price cuts, said Eric Enloe, a Chicago-based executive in JLL’s valuation division. Adjustments were necessary because of the grave uncertainty facing those properties’ rent rolls, he said.

“At that point, there was a question whether office tenants would pay the rent or they would walk away,” Enloe explained. “There was economic risk… and a lot of uncertainty on how long this would last, whether there would be a vaccine, when people would get back into the office.”

The initial shock that froze the office market has been somewhat alleviated thanks to the widespread availability of vaccines, but uncertainties remain over future demand for office space. A majority of employees have yet to return to their workplaces, and even if they do go back in the near future, many of them will not report five days a week.

Some predict that the longer people work from home, the more likely the style will stick. And the more it sticks, the more substantial its impact on the values of office buildings will be.

“We think work from home is going to affect commodity office products more,” said Kevin Shannon, co-head of U.S. capital markets at Newmark. “That habit is going to have minimal impact on Class A, newly built or repositioned products.”

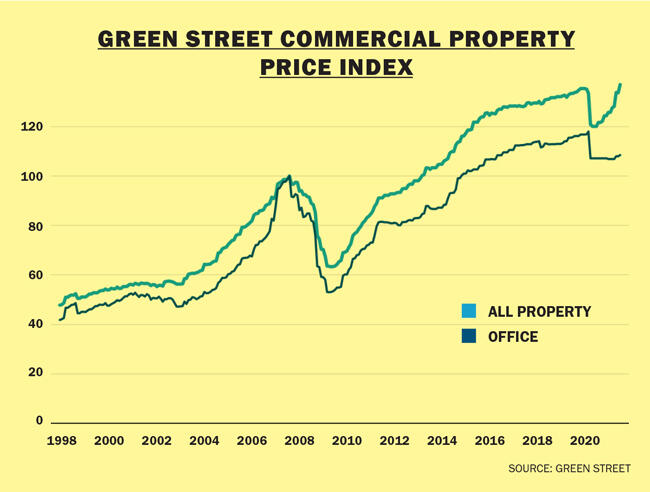

An analysis from Green Street shows that U.S. office property values as of July — the latest available at press time — were about 8 percent lower than March 1, 2020. In fact, offices, along with malls, are the two sectors that have yet to show strong signs of a rebound from their pandemic lows, with the office index staying almost flat for 16 months. Meanwhile, the all-sector index has gone back up above pre-pandemic levels, thanks in part to an industrial real estate boom.

Distress test

To gauge the potential impact of flexible working patterns on office real estate’s cash flows and values, Fitch Ratings’ Steven Marks conducted a stress test, exploring a scenario in which all office employees with the ability to work from home did so 1.5 days a week, on average. According to the analysis, this hybrid setup would lead to nearly 20 percent fewer people in the office on a given day.

But in the flex-working era, an office with 20 percent fewer people wouldn’t necessarily require 20 percent less space. So the team used a 2:1 ratio. An office with 20 percent fewer people would likely require 10 percent less space, with the excess used for breakout rooms, training areas or collaborative space, Marks said.

Historically, when occupancy goes down, average rents go down a bit further, while landlords’ expenses do not see commensurate reductions. The Fitch team concluded that 10 percent less space would lead to a 15 percent decline in net cash flows, and the value of office properties would drop by about 45 percent as a result.

If people work remotely three days a week, the stress test indicated, the value of office properties would tumble 54 percent.

Marks emphasized that Fitch hasn’t used this stress test information for rating purposes, as each property has different fundamentals, including terms of existing leases and major tenants’ creditworthiness, and that the stress test was a way to illustrate the potential magnitude of the impact of continued remote work.

Marks noted that many of the metrics used in the analysis, such as average days spent working remotely and how those working patterns will impact space needs and rents, are very much in flux.

“We do think that the story is yet to be written,” he said.

Long-term cushion

Office landlords and those peddling their buildings say that the true impact of hybrid work patterns on property values could vary greatly depending on the classification and location of each property. In particular, David Heller, of Savills’ capital markets group, disagreed with the notion that a hybrid work model will lead to a reduction in space.

“A lot of companies are recognizing that, yeah, perhaps we need to offer some form of flexibility,” Heller said. “But if everybody’s in the office three days a week, they can’t really shed office space because invariably, they’re going to be in on some of the same days.”

On the capital markets side, investors who recently traded office buildings haven’t taken the impact from flexible working into their acquisition price assumptions, said Mark Godfrey, who leads CBRE’s valuation team.

“They’re looking at stability happening, and a return to more pre-Covid type market conditions as the world recovers,” Godfrey said.

Indeed, the latest cap rates for Class A office properties in Manhattan, for example, are the same as they were in the second half of 2019 — between 4.5 and 4.75 percent for stabilized properties, according to a CBRE survey.

The consistency implies that the investment risk in Manhattan’s Class A office properties has not changed as a result of the pandemic. This is in stark contrast to the borough’s office leasing market, where vacancies are at record highs and the average asking rent hit a four-year low in August, according to Colliers International.

Nationwide, office leasing is showing some signs of recovery, with 29 percent more leases signed in the second quarter than in the first. But leasing volume was still 40 percent below its pre-pandemic quarterly average, and net absorption remained negative, according to JLL.

Office landlords owe their relative financial stability in the pandemic mostly to the long-term nature of office leases. Even when landlords saw cash flows decline due to vacancies, they’ve been able to withstand it because — unlike during the global financial crisis — they weren’t over-leveraged, said Lisa Pendergast, executive director at CRE Finance Council, a trade group for commercial real estate lenders.

“Loans were underwritten at much lower loan-to-value ratios,” she said. “So your leverage was not as high, and so your cash flow doesn’t need to be exceptional in order to make your debt payment.”

Savills’ Heller agreed.

“Even if my cash flow is decreased for a certain period of time, because my debt service is lower, my coverage is still there,” he explained. “So I can still support a fairly healthy financing environment.”

As a result, there have been far fewer distressed office properties on the market, and bargain-hunting investors were mostly left disappointed.

The name on the door

Investors are flocking to office buildings occupied by a major single tenant with a long-term lease, and the value of those properties has risen higher than before the pandemic, said JLL’s Enloe.

“There’s tremendous demand, both domestic capital and foreign capital, chasing those transactions,” Enloe said.

In July, South Korean real estate investor JR Asset Management Company paid $282.6 million to acquire a Google-leased 222,000- square-foot office building in the Silicon Valley city of Mountain View, according to real estate publication The Registry. The sale price works out to about $1,273 per foot.

And in May, Brookfield Asset Management bought a Facebook-leased 198,000-square-foot office building in Bellevue, Washington, for $200 million, or $1,010 a foot. It was Brookfield’s second purchase in the neighborhood, following a $365 million acquisition in October of a 338,000-square-foot office building ($1,080 per foot), also fully occupied by Facebook, according to local media reports.

(It’s notable that both Google and Facebook have delayed their return-to-work plans to at least January 2022 and have said they will allow certain employees to work from home permanently.)

Newmark’s Shannon, who is based in Los Angeles, maintained that while most office markets on the West Coast are still struggling because of the pandemic, certain cities are doing exceptionally well, and Bellevue is one of them, thanks to such tech giants as Amazon, Microsoft and Apple, in addition to Facebook, that are all gobbling up office space.

Another hot market is Burbank, California, which has become a battlefield in the streaming wars with Netflix, Disney and Comcast each taking up office space in the city, and San Diego, where office supply is shrinking because of ongoing office-to-lab conversions to accommodate a thriving life sciences industry.

“They are having bidding wars in those markets because the fundamentals are clear,” Shannon said. “In most markets, though, there’s not as much transparency on the fundamentals, and you’re waiting for data points on what rents are going to be post-Covid, and what absorption is going to be.”

The trend isn’t confined to the West Coast. Citing marketing materials, Bloomberg reported on Aug. 31 that Kevin Hoo’s Cove Property Group is looking to sell Hudson Commons, its 25-story, 700,000-square-foot office building on west side near Hudson Yards, for more than $1 billion.

Nearly half the building’s space serves as the corporate headquarters of Peloton, whose $92 per-square-foot lease runs through 2035. A further 100,000 square feet is leased by Lyft through 2029.

Structural impairments

Still, industry players all agreed that this flight to quality — in which tenants seek more updated office products to attract talent — is real, and values of outdated office buildings are likely to suffer.

“There’s a structural shift in the market, where the Class B buildings are going to be structurally impaired,” said RXR’s Rechler. “Even as the economic cycle recovers, I don’t think those values are going to recover.”

The trend is affecting not only Class B and C buildings, but some Class A properties, too, leaving so-called “trophy” buildings as the only winners.

According to Avison Young’s Craig Leibowitz, average net effective rent — base rent minus tenant improvement allowance and free rent — for Class A, B, and C buildings has dropped by more than 10 percent in the pandemic, while average net effective rent for trophy buildings — defined as the top 10 percent of the market — has stayed the same.

One trophy building is SL Green Realty’s newly constructed Midtown Manhattan skyscraper One Vanderbilt, which, according to documents viewed by The Real Deal, is currently asking rents ranging from $130 per square foot all the way up to an eye-popping $322 per square foot. SL Green closed on the $3 billion refinancing of the tower in June, a major endorsement from Wall Street that top buildings will hold their value.

Greg Kraut, co-founder and CEO of KPG Funds, which specializes in modernizing mid-market office buildings, said he hasn’t seen prospective tenants looking to shrink footprints. Instead, tenants have requested more thoughtful, healthy, efficient use of space, including more common areas, amenities, collaborative meeting spaces and breakout rooms, to welcome back their employees and attract top talent.

Kraut added that he’s seen more buying opportunities in the past nine months or so, as values of not-so-attractive buildings have come down.

“What we look at is the unrenovated, untenanted buildings in high-demand areas,” Kraut said. “There’s a significant discount to what it was before the pandemic.”

Kraut’s vision may be shared by Black Rock buyer Harbor Group International. The firm, led by Jordan Slone, already announced plans to make “significant upgrades” to the skyscraper’s interiors and amenities prior to closing the deal.

“This is the opportunity of a lifetime,” Kraut added.

Read more

ViacomCBS sells Black Rock building to Harbor Group for $760M

ViacomCBS sells Black Rock building to Harbor Group for $760M

KPG signs long-term ground lease for 57K sf at 132 West 14th Street

KPG signs long-term ground lease for 57K sf at 132 West 14th Street

Coffee Talk: Scott Rechler on beating the pandemic

Coffee Talk: Scott Rechler on beating the pandemic