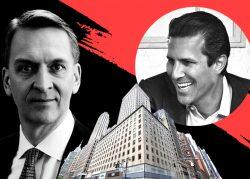

Things have gone from bad to worse for Harbor Group International’s retail property at 445 Fifth Avenue.

A year after its affiliates were hit with a foreclosure suit by Canadian bank CIBC for missed payments on the $40 million loan used to acquire the retail portion of the building, the investment firm finds itself facing fresh allegations from a new lender.

Torchlight, a private real estate investment firm with a nose for distressed properties, purchased the loan from CIBC in March. In June, a New York Supreme Court judge allowed a Torchlight debt fund to take the place of CIBC as a plaintiff in the ongoing foreclosure suit.

Now, Torchlight claims the Harbor Group entities failed to make additional required payments.

In an amended complaint, Torchlight alleges that it was not paid back for making “protective advances” to the property’s temporary receiver for the amount of $1.3 million in April and $132,000 in June. Torchlight also alleges it is owed $40 million of the loan’s outstanding principal sum.

Harbor Group filed a motion to dismiss the amended complaint this month, claiming the Torchlight debt fund never properly obtained the mortgage. A court status order said Torchlight and Harbor Group have exchanged settlement offers but “are far apart on terms.”

Read more

Harbor Group bought the retail portion of the 33-story Fifth Avenue condo tower from Thor Equities for $68 million in 2015.

Last year, the Australian firm Brickworks signed a 10-year lease to occupy most of the property. The retail corridor was previously leased to jewelry store Charming Charlie, which filed for bankruptcy in 2017 and again in 2019.

The foreclosure suit marks the latest sign of retail’s struggles on Fifth Avenue. Brookfield Property Partners is in contract to sell its block-long retail condo at nearby 530 Fifth Avenue for around $190 million — roughly a third less than the $295 million it paid for the property near the height of the market in 2014.

Earlier this month, citing low occupancy and “negative income,” Vornado Realty Trust announced it had reached agreements to sell five retail properties for $184.5 million, incurring a $7 million loss.

While funds have raised billions of dollars to purchase cheap real estate assets and debt, an anticipated wide-scale buying spree has yet to arrive. Still, Torchlight has managed to be involved in a few distress situations.

In January, the firm took control of a 44-story Times Square hotel after the owner stopped making payments on its mortgage. In March, Torchlight filed the foreclosure action against a hotel owner in Miami’s Brickell area that resulted in the owner filing for bankruptcy.

A lawyer for Torchlight did not return a request for comment. Harbor Group did not return a request for comment.