Amazon to open 100 more US facilities in September

Amazon to open 100 more US facilities in September

Trending

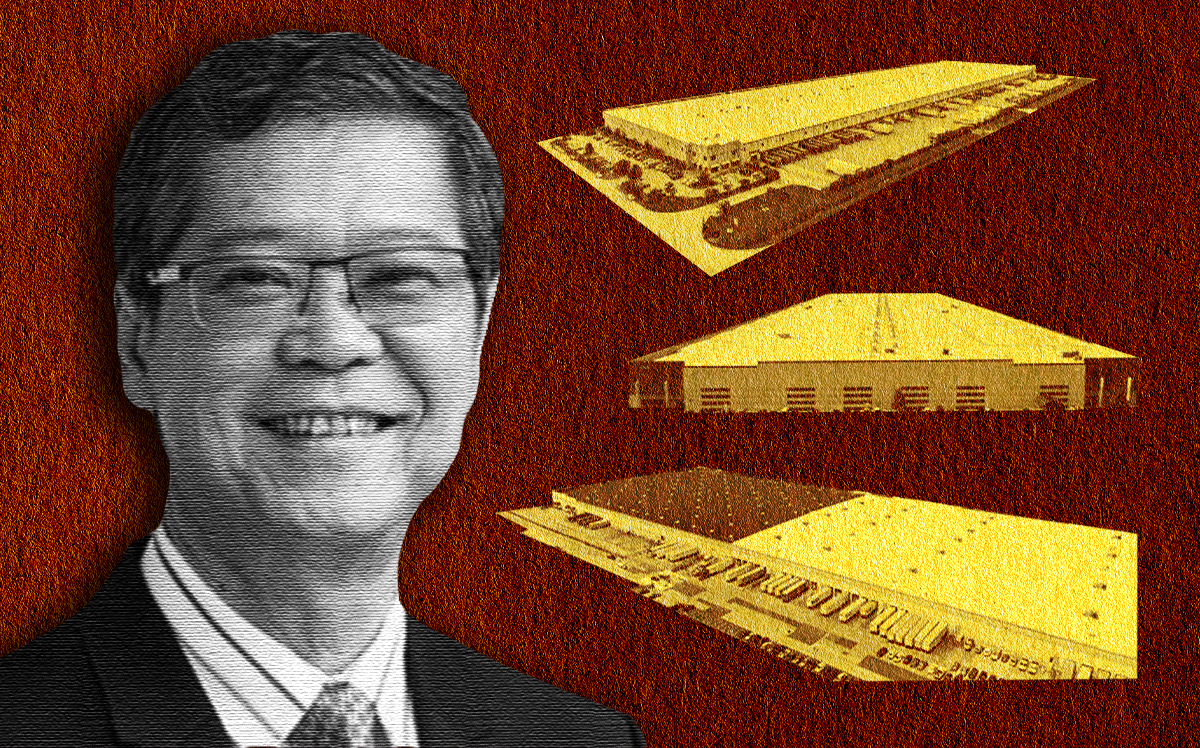

Singaporean REIT acquires US industrial portfolios for $3B

Mapletree picks up 141 properties across Chicago, Boston, Dallas

One of Singapore’s largest REITs recently acquired two industrial portfolios in the U.S., bringing its logistics ownership to over 70 million square feet.

This month, Mapletree Investments acquired 117 properties totaling 22.3 million square feet in Chicago, Memphis, Houston and other markets, the company announced Thursday. The seller was not disclosed, and the REIT did not immediately respond to an inquiry.

The deal follows the company’s July purchase of 24 properties totaling 6.1 million square feet. Mapletree spent $3 billion on the two portfolios combined, the firm said.

The real estate investment trust said it has enough scale and investor interest to create a private fund for those 141 U.S. logistics properties plus the 14 it already owned.

Read more

Amazon to open 100 more US facilities in September

Amazon to open 100 more US facilities in September

LB Asset Management, AIG target Southeastern industrial properties

LB Asset Management, AIG target Southeastern industrial properties

The U.S. industrial real estate market is seeing insatiable demand, fueled by a boom in e-commerce during the pandemic. Industrial rents hit all-time highs in the second quarter of this year at $6.62 per square foot, according to data from JLL. And investors from all over the world are betting big on continued growth.

Last month, Canadian firm Oxford Properties Group said it would purchase a 14.5-million-square-foot industrial property portfolio from KKR for $2.2 billion.

Mapletree is interested in more than just industrial real estate. The firm recently raised $552 million for its first U.S.-focused office fund, which already includes five commercial properties totaling 285,000 square feet.