When Jabari Brisport thinks about New York’s housing crisis, he blames developers. When I think about the crisis, I blame politicians. Brisport, for one.

As a state senator, Brisport doesn’t control the zoning that limits homebuilding and drives up prices. But he fuels an anti-development narrative that perpetuates the problem.

After a developer proposed replacing a McDonald’s at 840 Atlantic Avenue with an 80 percent market-rate apartment building, the Brooklyn senator said such projects are “bleeding out Black people from the community.”

Portraying developers as bloodsuckers is incendiary on its face. But it’s also counterproductive to the goal of lowering housing costs because it rallies opposition to the primary solution, which is more housing.

Brisport is hardly alone. A vocal minority of activists is convinced that any new market-rate housing — even with affordable units mixed in — causes rent hikes and displacement.

This is one of those pernicious myths that endures because it seems plausible, like the falsehood that vaccines cause autism. Because autism symptoms manifest after the age at which children receive certain vaccinations, the shots were fingered as the culprit by parents seeking to explain the inexplicable. A fabricated report initiated the lie, giving rise to an anti-vaxxer movement that is now killing tens of thousands of people.

It’s easy to confuse cause and effect. Developers build where rents are going up, and people like Brisport erroneously conclude that new housing triggers rent growth, rather than the other way around.

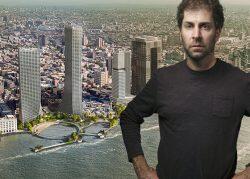

Brisport would not consent to an interview, but an aide emailed me some observations and links in an attempt to justify his comments about 840 Atlantic Avenue. The Prospect Heights project calls for 270 apartments, including 54 affordable to those earning just 40 percent of the area median income.

I sent the aide — a longtime Democratic Socialists of America organizer — a detailed response, but let’s boil the issue down.

Most people understand that if supply does not keep pace with demand, prices go up. If a jobs boom brings new renters to New York City, and we don’t add homes, bidding for existing ones will intensify. I doubt Brisport, who also hails from the Democratic Socialists of America, would dispute that.

His argument is that adding market-rate housing raises rents in the immediate neighborhood. Stores and restaurants open to serve the high earners, whose kids boost test scores at local schools. The developer might build a promenade and the Parks Department might respond to a community’s calls to add pickleball courts.

Brisport’s belief is that in response to these improvements, landlords raise rents. Researchers call this the “amenity effect” or “induced demand.” Unimpressed that new housing offsets citywide increases in demand, the senator asserts that it triggers demand locally and pushes neighborhood rents up.

His aide further claimed that the new stores and restaurants displace smaller businesses, many Black-owned, prompting some poor people to move away because they can no longer afford local goods and services.

She pointed to “an entire academic field” of research on how high-income arrivals affect existing tenants, and cited an NYU Furman Center for Real Estate report as an example.

I called Furman. Furman says its research, and that of the academic field as a whole, shows housing development depresses rents by increasing supply, not just regionally but locally.

It pointed to a number of researchers, including one of its own, Xiaodi Li, whose study of New York City apartment towers found that they do attract new restaurants, but rents still fall by 1 percent for every 10 percent increase in housing supply within 500 feet.

Other examples: Evan Mast of the Upjohn Institute showed how people moving into new development makes less-expensive housing available for others. Kate Pennington of UC-Berkeley found rents fall by 2 percent within 100 meters of new developments in San Francisco, while renters’ risk of moving to a lower-income neighborhood falls by 17 percent.

I have been reading studies like these for years, but for an update, UCLA just conducted a good roundup on the question of local impact. It wrote:

Researchers have long known that building new market-rate housing helps stabilize housing prices at the metro area level, but until recently it hasn’t been possible to empirically determine the impact of market-rate development on buildings in their immediate vicinity. The question of neighborhood-level impacts of market-rate development has been hotly debated but under-studied.

Taking advantage of improved data sources and methods, researchers in the past two years have released six working papers on the impact of new market-rate development on neighborhood rents. Five find that market-rate housing makes nearby housing more affordable across the income distribution of rental units, and one finds mixed results.

Did you catch that? Five of the six studies found that new housing makes existing local housing more affordable for everyone from the wealthy to the poor. The amenity effect is real, but adding supply more than offsets it. The upshot: better amenities, lower rents. Seems like a win-win.

What about the one study with mixed results? It showed rents on inexpensive units increasing marginally within 300 meters of purely market-rate development in Minneapolis, but failed to account for inflation. When the UCLA researchers fixed that error, they found rents over 18 years were unchanged in low-tier units and fell by 7 percent overall.

And lest we forget, 840 Atlantic will not be 100 percent market-rate. One of every five units will be affordable to a family of three earning $42,960 per year.

So, six studies out of six. But who’s counting? Not Brisport.

I do think the senator wants housing to be affordable. And I don’t think his “bleeding out Black people” comment was disingenuous. Rather, it reflected a phenomenon well known to psychologists: When people become invested in a position, they cling to it — even more so when confronted with contrary evidence.

Read more

I am susceptible to that as well. But the research overwhelmingly shows that adding housing helps affordability. That aligns with economic theory: More supply lowers prices, not just in a city or a metro area, but in a neighborhood and even on the surrounding blocks.

Capitalism has a strong track record of producing enough goods and services to meet demand. But housing is one of the few things that politicians do not allow the market to produce at will: They limit the supply with zoning. Not coincidentally, there is a perpetual shortage in many cities. Nationwide, we are 3.8 million homes shy of demand.

At the risk of droning on, I have a few more points.

The Brisport aide’s assertion that poor people cannot afford goods and services in gentrifying areas deserves attention. Undoubtedly, the next restaurant that opens near 840 Atlantic Avenue will be more expensive than the McDonald’s being replaced.

But poor people do not move to be near fast-food joints. Rather, fast-food chains open near poor people. So do high-fee check-cashing businesses and bodegas, where a box of cereal might cost twice as much as in supermarkets.

The effects of location on people’s lives are well known. Where the choices are fast food and convenience stores, outcomes for low-income kids are bad. In high-opportunity areas, with supermarkets, banks, and schools with advantaged students, outcomes for low-income kids are better.

The question is whether poor kids can stick around to reap the benefits of higher-income people moving in. Studies show they can, if housing is built to absorb the newcomers.

Brisport’s aide pointed to Furman data showing the percentage of Black residents declined more in gentrifying areas such as Harlem and Bedford-Stuyvesant than in non-gentrifying areas. But Furman defined “gentrifying” as being low-income in 1990 and experiencing above-average rent increases through 2014. They were less affordable by definition.

Neither Furman nor another report cited by the aide said development caused rent growth. Instead, the lack of it did. Demand to live in these neighborhoods grew faster than the supply of homes. Some Black renters were outbid and some Black homeowners sold their brownstones for huge profits.

Turnover — people moving in and out — is frequent in low-income households. But it’s lower for poor folks in gentrifying areas than in non-gentrifying areas. Rather than move out because a sit-down restaurant replaces the local McDonald’s, they resolve to stay.

The goal is to get the amenities without the rent increases. The data show that adding housing, especially mixed-income projects like 840 Atlantic Avenue, achieves that.

Of course, adding housing by rezoning rich areas such as Soho is also essential: It puts downward pressure on rents citywide by adding supply, and because of the city’s Mandatory Inclusionary Housing law, it brings low-income families to high-opportunity areas.

What about the many New Yorkers who cannot afford market-rate housing in Soho, yet earn too much to qualify for income-restricted units? Without projects like 840 Atlantic Avenue, they have two options: displace lower-income families or move to the suburbs.

That is the evidence that Brisport is wrong. Unfortunately, according to psychologists, reading it will leave him more certain than ever that he is right.