Just a few months after filing for Chapter 11, mall operator Washington Prime Group has emerged from bankruptcy.

When the real estate investment trust, which owns more than 100 malls across the country, filed for bankruptcy protection in June, it listed $4 billion in assets and $3.5 billion in debts. Through the process, the company has reduced its debt by nearly $1 billion.

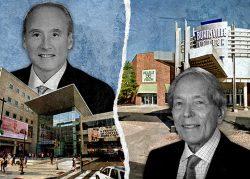

WPG’s Josh Lindimore and Mark Yale

The company also announced that Lou Conforti is stepping down as chief executive officer. Mark Yale, the executive vice president and chief financial officer, and Josh Lindimore, the executive vice president and head of leasing, will serve as interim co-CEOs.

“It is a ‘new beginning’ for WPG, and myself,” Conforti said in a statement.

The bankruptcy had been a long time in the making for Washington Prime. In November, Conforti said that bankruptcy was off the table. However, in March, talks on bankruptcy once again emerged, before the company filed in June.

Read more

Washington Prime Group was formed when it spun off from Simon Property Group in 2014.

Like other mall operators, the REIT has struggled with foot traffic and competition from e-commerce. The pandemic was the final straw, as it sent rent revenue plunging. Washington Prime collected just 52 percent of the rent due in the second quarter of 2020.

The firm followed fellow mall operators CBL & Associates Properties and Pennsylvania REIT into bankruptcy. In March, CBL announced that 88 percent of voting bank lenders and 64 percent of voting noteholders approved an amended restructuring support agreement. Neither company has emerged from bankruptcy.